Every six months, the anxiety of deterioration grips the Bercy teams again. In this deadly spring for the credibility of the State in terms of managing its finances, the atmosphere is becoming more stifling while awaiting the verdict of the three major rating agencies: Fitch and Moody’s this Friday, April 26, and Standard & Poor’s (S&P) at the end of May. The risk ? A downward revision of the rating assigned to French debt, by at least one of them. “The rating is not an opinion on the quality of public policy or country risk, but rather on the capacity of the State, as a borrower on the capital markets, to repay its debt, supports Aymeric Poizot , head of France at Fitch Ratings, in speeches, this rating is sometimes invoked as a totem. Other times, it is referred to as a broken thermometer. In reality, the use made of it by the political class is completely independent. We.”

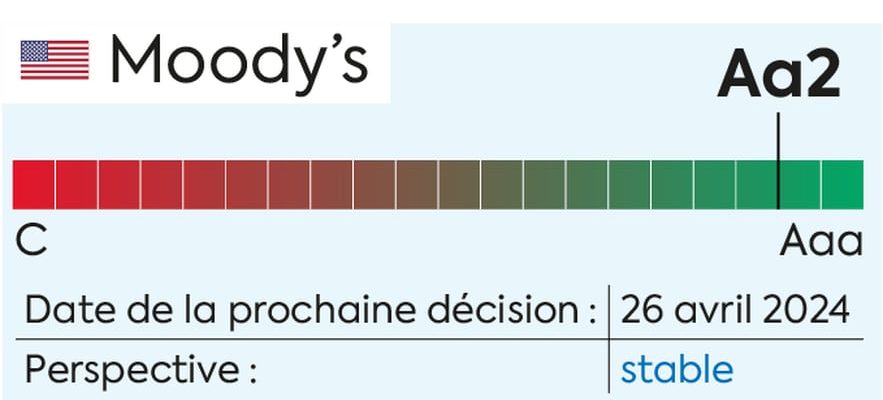

It was also Fitch which carried out the latest downgrade, almost a year ago, from AA with a negative outlook to AA- with a stable outlook. The slippage in the deficit to 5.5% made official on March 26 proved him right a posteriori, estimates the analyst in charge of the French file, Hannah Dimpker. “We have a more conservative point of view than that of the French government in our forecasts, it would have taken more for us to be surprised,” she remarks. In the process, the agency qualified the impact of INSEE’s announcement: “Any other negative rating action would depend on a further significant worsening of public debt, which we consider unlikely.” Will Moody’s and S&P be less lenient? The first expressed its doubts on March 27 about France’s ability to reduce the deficit to 2.7% in 2027. The second, more closely scrutinized, is being kept quiet for the moment. But its AA rating has been accompanied by a negative outlook since the end of 2022.

No black boxes

This political-media interest in agencies belongs to recent history. They have been accused of having contributed to the financial crisis of 2008 and that of European debts. Since then, regulations have tightened to govern them. “We respect a calendar, announcing the date of publication of our decisions, twice a year, which does not exclude a change of rating in the meantime if new information or an event justifies it,” explains Aymeric Poizot. To keep fresh eyes and guard against complacency, analysts change portfolios every four years. They review a 250-page manual each year to validate their skills. “Our methodologies are absolutely not ‘black boxes’. Anyone who claims otherwise has never taken the time to go to our website, where our rating criteria and our sovereign model are available in complete transparency and in detail”, maintains the Fitch manager.

NEW3799_TABLEAU_COVER

© / The Express

Growth forecasts, GDP per capita, the public deficit, the interest charge, etc. are scrutinized, and a “qualitative” analysis is added. It was on this rock that the executive stumbled last year. In the wake of the movements against pension reform, Fitch was concerned about the social obstacles to the actions taken. Hannah Dimpker summarizes: “It seems more difficult in France than in other countries to reduce spending, partly for political reasons. In the same way, the rate of compulsory deductions is already so high that it is difficult there to raise taxes.” Bad point for the student France.

Meeting with Bruno Le Maire

In order to perfect their opinion, Fitch experts meet with technicians from Agence France Trésor – state debt manager – to explain a forecast and understand a reform, especially if they are not French. They go through the literature of commentators on the French economy, speak with the High Council of Public Finances, the Bank of France, and visit the big banks if necessary. Does their exploration lead them to the minister himself? Officially, no one dares to admit it. But L’Express revealed last year that Bruno Le Maire had indeed met S&P. “In certain countries, we are asked to speak to the Minister of Finance, in which case we accept, of course”, replies Fitch, without more precision. At the very least, we discuss with Bercy advisors. “We have frequent contact with the executive, who is very responsive. This is not true everywhere.”

Whatever happens, at some point, the person concerned must be informed of the sentence. The decision is collegial, taken by a rating committee which brings together analysts, senior experts, independent members… “In accordance with our procedures for all ratings, we send the draft press release, and the government can, if necessary, correct a factual error or reporting something that should have remained confidential,” explains Hannah Dimpker, based in Frankfurt. The State has twenty-four hours to appeal. And a little more to prepare its communication, if ever the decision proves to be upsetting, before the publication on Friday after Wall Street closes.

In the event of bad news, will investors raise their eyebrows? Not sure. Even if it is downgraded by one notch, French debt will retain its popularity with the markets. Paris should easily find buyers for its securities issues – 285 billion euros expected in 2024, a new record. And in correct conditions. “The rating is only one of the determinants of the financing rate for developed countries, notes Aymeric Poizot. For two years, in Europe, the cost of debt has been entirely motivated by the monetary policy of the European Central Bank, not by rating.” Politically, on the other hand, the consequences are likely to be far more serious.

.