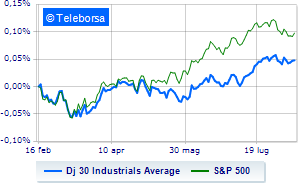

(Finance) – A “bad” day for the US stock market, down 0.88% on Dow Jones, breaking the positive chain of three consecutive increases, which began last Thursday; along the same lines, bad day for theS&P-500which continues the session at 4,448 points, down 0.93%.

Down the NASDAQ 100 (-0.8%); on the same trend, negative theS&P 100 (-0.85%).

Strong nervousness and losses across the S&P 500 across all sectors, bar none. In the list, the worst performances are those of the sectors power (-2.50%), financial (-1.67%) and materials (-1.64%).

Among the best Blue Chips of the Dow Jones, Amgen (+2.04%) and Home Depot (+0.61%).

The worst performances, however, are recorded on Dowwhich gets -2.95%.

He suffers Caterpillarwhich shows a loss of 2.46%.

Prey of sellers Chevronswith a decrease of 2.42%.

They focus their sales on JP Morganwhich suffers a drop of 2.20%.

Between best performers of the Nasdaq 100, Amgen (+2.04%), work day (+1.67%), Nvidia (+1.13%) and Align technology (+1.07%).

The worst performances, however, are recorded on polishwhich gets -5.76%.

It collapses PayPalwith a drop of 5.04%.

Sales on Micron Technologywhich records a drop of 3.38%.

Bad sitting for PDD Holdingswhich shows a loss of 3.35%.

Between macroeconomic variables of greatest weight in the North American markets:

Tuesday 08/15/2023

2.30pm USA: Export Prices, Monthly (exp. 0.2%; prev. -0.7%)

2.30pm USA: Empire State Index (expected -1 points; previous 1.1 points)

2.30pm USA: Retail sales, annual (exp. 1.5%; previous 1.6%)

2.30pm USA: Retail Sales, Monthly (exp. 0.4%; prev. 0.3%)

2.30pm USA: Import prices, monthly (0.2% expected; previous -0.1%).