(Finance) – The Wall Street stock exchange continues negative in the session of a short week: the stock markets will remain closed for Good Friday. There is expectation among investors for inflation data: consumer prices for March are scheduled for tomorrow, while Wednesday will be the turn of the producer prices. In the meantime, the quarterly season kicks off, with the bank accounts.

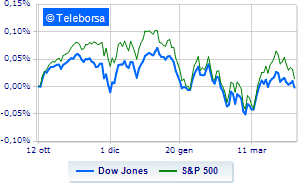

Among the US indices, the Dow Jones it is leaving 0.77% on the parterre; along the same lines, widespread sales onS & P-500, which continues the day at 4,432 points. The bad Nasdaq 100 (-1.64%); with a similar direction, negative changes for theS&P 100 (-1.43%).

All sectors of the S&P 500 are down on Wall Street. power (-3.31%), informatics (-2.00%) e sanitary (-1.60%).

Between protagonists of the Dow Jones, Verizon Communication (+ 1.10%), Goldman Sachs (+ 0.75%), Travelers Company (+ 0.73%) e 3M (+ 0.60%).

The worst performances, on the other hand, are recorded on American Expresswhich gets -3.42% after a downgrade.

Sensitive losses for Microsoftdown 3.40%.

Breathless Chevronwhich falls by 2.94%.

Thud of Nikewhich shows a fall of 2.14%.

Between protagonists of the Nasdaq 100, Ross Stores (+ 3.11%), NetEase (+ 3.06%), Okta (+ 2.41%) e JD.com (+ 1.80%).

The strongest sales, on the other hand, show up on Nvidiawhich continues trading at -5.11%.

Letter on Idexx Laboratorieswhich records a significant decline of 4.59%.

Goes down Constellation Energywith a decline of 4.18%.

Collapses Seagenwith a decrease of 3.86%.

Between the data relevant macroeconomics on US markets:

Tuesday 12/04/2022

14:30 USA: Consumption prices, annual (expected 8.5%; previous 7.9%)

14:30 USA: Consumption prices, monthly (expected 1.2%; previous 0.8%)

Wednesday 13/04/2022

14:30 USA: Production prices, monthly (expected 1.1%; previous 0.8%)

14:30 USA: Production prices, annual (expected 10.5%; previous 10%)

16:30 USA: Oil stocks, weekly (previous 2.42 million barrels).