(Finance) – The Wall Street Stock Exchange reopens with indexes moving in negative after being closed on the eve of holidays. Investor attention remains focused on central banks convinced that the Federal Reserve should remain on its “hawk” path, despite theinflation is down from its peak, but still remains elevated, and the unemployment rate is at a 53-year low. Tomorrow will be published i minutes of the last meeting of the American central bank: insiders hope to glean indications on the future conduct of monetary policy.

Meanwhile in the background we look at the evolution of geopolitical situationwith fears of an escalation of the conflict, in Ukraine, thanks to the fact that the Russian president, Vladimir Putin, has reaffirmed his willingness to continue operations to achieve the objectives of the invasion.

On the quarterly front, focus on Home Depot after the home improvement retailer reported lower-than-expected fourth-quarter revenue, even as it beat earnings estimates. Eyes up too Walmart which released its latest disappointing quarterly results.

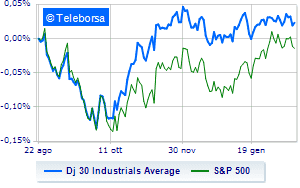

Among US indices, the Dow Jones shows a decline of 0.89%; along the same lines, bad day for theS&P-500, which continues the session at 4,043 points, down 0.88%. In red the NASDAQ 100 (-0.96%); with the same direction, downhill theS&P 100 (-0.88%).

All the titles go down large market capitalization the Dow Jones.

Sitting in the name of red for all Nasdaq 100 stocks.

Between macroeconomic variables of greatest weight in the North American markets:

Tuesday 02/21/2023

3.45pm USA: Manufacturing PMI (exp. 47.1 points; previous 46.9 points)

3.45pm USA: PMI services (expected 47.1 points; previous 46.8 points)

3.45pm USA: Composite PMI (expected 47.5 points; previous 46.8 points)

4:00 pm USA: Existing home sales, monthly (exp. 2%; previous -1.5%)

4:00 pm USA: Sale of existing houses (expected 4.1 million units; previous 4.02 million units).