(Finance) – A “bad” day for the US Stock Exchange, where there is nervousness among operators due to the risk that central banks could cause a recession due to the measures adopted to keep inflation under control.

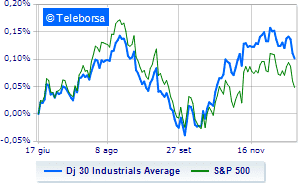

Among US indices, the Dow Jones shows a decline of 1.49%; along the same lines, quite a lot is soldS&P-500, which continues the session at 3,833 points. Down the NASDAQ 100 (-1.33%); as well, bad theS&P 100 (-1.52%).

In the S&P 500, no fund is saved.

Bad day for all Dow Jones Blue Chips, which show a negative performance.

The worst performances are recorded on American Expresswhich gets -3.69%.

He suffers Nikewhich shows a loss of 2.63%.

Prey of sellers Salesforce,with a decrease of 2.48%.

They focus their sales on intelwhich suffers a drop of 2.35%.

To the top between Wall Street tech giantsthey position themselves Adobe Systems (+3.40%), Meta Platforms (+3.00%), synopsis, (+1.00%) and JD.com (+0.92%).

The strongest declines, however, occur on Modernwhich continues the session with -7.17%.

Letter about Tesla Motorswhich records a significant drop of 4.31%.

Goes down light up,with a drop of 4.20%.

It collapses Align Technology,with a decrease of 4.03%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Friday 12/16/2022

3.45pm USA: Composite PMI (expected 47 points; previous 46.4 points)

3.45pm USA: Manufacturing PMI (exp. 47.7 points; previous 47.7 points)

3.45pm USA: PMI services (expected 46.8 points; previous 46.2 points)

Monday 12/19/2022

4:00 pm USA: NAHB index (previously 33 points)

Tuesday 12/20/2022

2.30pm USA: Building permits (previous 1.53 million units).