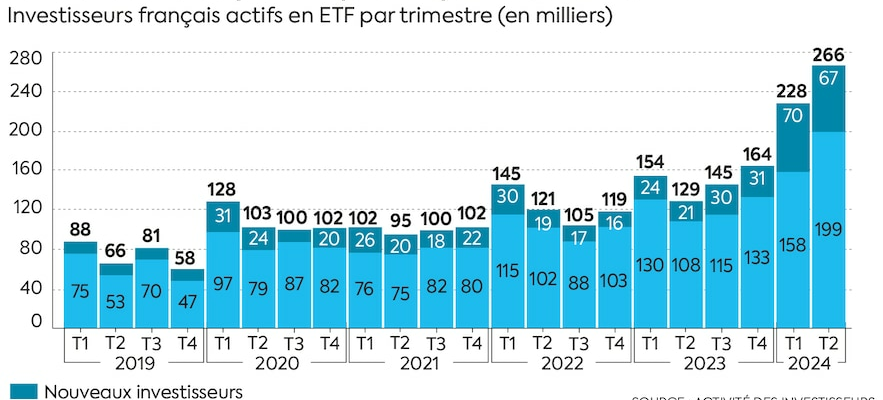

If ETFs (exchange traded funds) took time to establish themselves in the panorama of investments for individuals, their growth is now spectacular. These instruments associated with passive management aim – for the most part – to reproduce a market index. A simple, readable and inexpensive approach when funds traditionally sold to savers seek to beat the market, with more or less success. Now better known and more widely available in general public savings funds, ETFs are attracting a growing number of stock market investors. The Financial Markets Authority (AMF) thus noted a fourfold increase in the number of French individuals having carried out at least one ETF transaction between the second quarter of 2019 and the second quarter of 2024.

Active French investors in ETFs per quarter (in thousands)

© / The Express

A craze that sparks heated debates between promoters of ETFs and defenders of active management. “Some think that active management can offset its costs with a good selection of securities and others believe that it is better to benefit from ETFs that replicate indices without paying significant management commissions,” summarizes Pierre-Marie Piquet, head of management under mandate of BNP Paribas Banque Privée France This duality has become more pronounced in recent years because active management has been put in difficulty due to markets driven by particular phenomena such as the explosion of the “Magnificent 7”. in the United States [NDLR : sept entreprises aux performances boursières exceptionnelles, Tesla et Nvidia en plus des Gafam].” However, nothing obliges us to choose a camp and entrench ourselves there. “We oppose two managements which can be complementary”, assures Denis Khamphou, portfolio manager at Myria AM (UFF group). Indeed, these instruments can combine to take advantage of their respective properties.

Difficult to do better than the S&P 500

Exchange traded funds are generally used to invest in major international markets, which represent the core of a portfolio. Indeed, the more investors and analysts a market attracts, the more transactions it records, and the more difficult it will be for a manager to do better than the index. This is the case of the American stock market, reputed to be particularly complicated to beat, especially for a French manager who does not have local teams. “On our Direct Placement Life contract, provided by Swiss Life, which gives access to 54 ETFs, the most subscribed to replicate major indices: the S&P 500, the MSCI World and the Nasdaq 100,” reports Henri Réau, director of development of the online broker. A conclusion also valid for the euro zone, unless you want to build up a portfolio of securities directly on this domestic market.

ETFs also lend themselves well to thematic investment because the offering has greatly expanded. “We have seen a lot of product development around themes such as infrastructure, biodiversity, artificial intelligence or even the circular economy, underlines Pierre-Marie Piquet. These products are close to active management because they replicate an index narrow composed of a selection of values.”

Furthermore, it is possible to combine this base with more typical management, offered by conviction-based managers. “ETFs make it possible to capture the rise in the market and active management provides potential outperformance, notes Denis Khamphou. The combination of the two stabilizes the portfolio by limiting the risk of erroneous bets.” Finally, the expertise of specialized managers may be favored for more specific asset categories such as small and mid-caps. “On a balanced life insurance portfolio with 50% funds in euros and 50% units of account, it is possible to invest three quarters of the unit of account pocket in the major global indices via ETFs and “bet the balance on smaller markets through managers carrying out stock selection”, estimates Henri Réau.

Savers with more reactive management of their portfolio, particularly within a securities account, will also be able to use ETFs to quickly increase their exposure to a market, these vehicles being continuously quoted, unlike funds. Finally, “we can reduce the proportion of ETFs when the dispersion of performance on a market makes active management more relevant,” adds Denis Khamphon. The advantage of having multiple tools serving the same goal: performance.

.