What if bankruptcy helped your destiny? Unthinkable, you might say! And yet… Let’s go back in time. It’s 2010, bitcoin has been around for a year and is only known in the very restricted world of geeks. A genius American computer developer, Jed McCaleb, has the idea of creating Mt. Gox, the first cryptocurrency exchange platform. He sells it a year later to the Frenchman Mark Karpelès. In three years, it establishes itself as the main “exchange” for bitcoin and boosts the price of the latter, which goes from 10 to 600 euros. Alas… Victim of a large-scale computer hack, Mt. Gox goes bankrupt, putting more than 10,000 customers out of business.

However, the company has nearly 150,000 bitcoins in its vaults. A trifle at the time, but with its price soaring over the years, this reserve has now reached the tidy sum of… 9 billion euros. Now, the courts have finally given their approval to the receiver to reimburse former customers who have filed a claim for compensation. Result? If you had invested 7,000 euros in a Mt. Gox account at the time, your compensation will happily exceed one million euros!

Much more than a simple anecdote, this story shows that in ten years the “bitcoin king” has established itself as a financial product in its own right, recognized by the world of finance. Its coronation was also made official during the launch, on January 11, of eleven index funds – ETFs or exchange-traded funds – entirely dedicated to this asset, after receiving approval from the SEC, the American stock market regulator.

Among the issuers of these funds, whose price automatically follows the evolution of the digital currency, we find high-flying management companies like BlackRock and Fidelity. Enough to reassure the most cautious about the respectability of this virtual currency. Moreover, these two funds have experienced tremendous growth. At the end of May, BlackRock’s bitcoin ETF, the iShares Bitcoin Trust, had already collected nearly 20 billion dollars under management. Fidelity, for its part, held the record for collection in twenty-four hours at the beginning of June, with 378 million dollars collected in one day by its ETF Fidelity Wise Origin Bitcoin Fund. Since these vehicles are required to hold bitcoins in their portfolios equal to the amount of capital they collect from investors, a virtuous circle has been set up. The more savers invest in this type of product, the more managers have to buy bitcoins to put them in reserve, the more the price of this asset increases and the more the ETFs perform well. The price of bitcoin has therefore increased by 50% in six months to reach a historic high of $73,800 in March, with the ETFs dedicated to it following in its wake.

The European financial market is not hermetically closed to cryptocurrencies

Faced with these performances, French investors could feel somewhat frustrated because European regulations do not allow investing in this type of fund. The UCITS directive stipulates this: only ETFs with a minimum level of diversification are authorized for marketing. Thus, ETFs dedicated solely to bitcoin find themselves “outside the law” in the eyes of ESMA, the European Union’s market surveillance body. “But for how much longer? The European financial policeman launched a vast consultation from May to August, underlines Pierre-Yves Dittlot, CEO of the Ledgity platform. It is asking financial players whether it would be appropriate to authorize UCITS accessible to the general public to integrate cryptocurrencies and bitcoin ETFs into their portfolios.”

In the meantime, should we resign ourselves to the role of spectator? No, because the European financial market is not hermetically sealed off from cryptocurrencies. There is a whole range of financial products that offer more or less strong links with them.

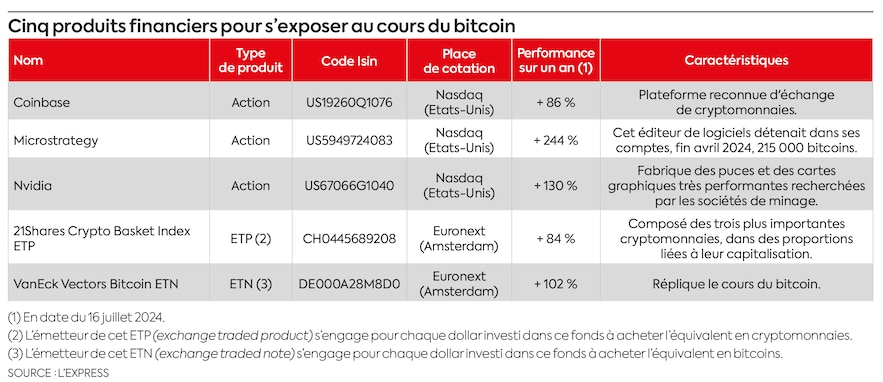

A first option is to buy shares in companies, primarily American, that come from the crypto economy. This is the case, for example, of the exchange platform Coinbase. Listed on the Nasdaq, this company’s results are correlated with the dynamism of this market since its activity and profits are largely linked to the collection of commissions on purchases and sales of cryptos and to the offer of financial services on the blockchain – the digital medium on which the operation of the virtual currency is based. Thus, in six months, the value of Coinbase shares has jumped by 82%! “With a war chest of at least 215,000 bitcoins in reserve in its accounts, the software publisher MicroStrategy sees its market capitalization evolve much more according to the price of bitcoin than that of its financial results”, observes Pierre-Yves Dittlot. Over the last six months, the share price has exploded by more than 200%.

ETP, ETN…

Chip card and graphics card manufacturers such as Nvidia or Advanced Micro Devices (AMD) are business partners of crypto players, such as mining companies that ensure the proper functioning of certain blockchains. Owners of ultra-powerful computer fleets, miners buy high-end equipment developed by these American electronics giants. Finally, firms specializing in the design and programming of algorithms as well as the development of cryptographic data, such as the American Galaxy Digital and the Japanese NTT Data, promote technological innovation in blockchain.

It is also possible to invest in ETPs (exchange-traded products) or ETNs (exchange-traded notes) authorized in Europe. Their legal form is different because they are not funds like ETFs, but bonds indexed to the performance of an underlying asset that can be bitcoin, ether or a basket of cryptocurrencies. They are listed on the stock exchange and can be held in a securities account. The VanEck Vectors Bitcoin ETN, which replicates the price of bitcoin, and the 21Shares Crypto Basket Index ETP, which tracks the performance of a basket of the ten largest cryptocurrencies, have climbed 118% and 96% respectively over the last twelve months.

3820CT INVESTMENTS bitcoin

© / The Express

Although the progress made is dizzying, savers must nevertheless keep a cool head and invest only in small doses, at most 5% of their portfolio. Because these assets, which are extremely volatile, can fall just as suddenly as they rose.

Ethereum ETF: a lackluster launch

While Bitcoin ETFs have been a real success, Ethereum ETF holders have reason to be disappointed. However, their launch, on July 23, had started well with more than a billion euros collected in the first week of listing from the nine ETFs issued by big names in finance. But Grayscale has stopped the momentum.

This management company launched the Grayscale Ethereum Trust fund in 2017. Savers who bought shares in this vehicle invested in ethers had difficulty reselling them because they had to go through a secondary market with little liquidity. When this product was transformed into an ETF listed under the symbol ETHE, many investors took the opportunity to exit!

Result: ETHE recorded an outflow of several billion dollars in August. Of course, these flows were partially offset by other ETFs, but this nevertheless had an impact on the price of ether, which has plummeted by 30% since July 23, dragging the associated ETFs in its wake. Thus, the prices of ETHA (Blackrock), FETH (Fidelity) and ETHW (Bitwise), the three main players, have fallen by around 20% since their launch. A real downward spiral.

An article from the special report “The best investments for the start of the school year”, published in L’Express on September 19.

.