At the beginning of November 2022, a bomb falls on the crypto planet. The bankruptcy of the FTX exchange platform leaves hundreds of thousands of investors on the floor, losing all of their savings. Something to think about all those who plan to invest in digital currencies.

To avoid this disappointment, the saver nevertheless has solutions. The first is to create a wallet, that is to say a personal electronic wallet, on the blockchain, to house and secure your cryptocurrencies. As soon as you have converted your euros into bitcoin – for example – via the platform of your choice, you transfer them without delay to your wallet. Your investments are no longer exposed to the vagaries of this intermediary. But you still have to be comfortable with computer tools.

If this is not your case, there is another possibility: investing in classic financial products, which have a direct or indirect link with the cryptosphere. Indeed, their prices will tend to follow the evolution of this market. “The first advantage of this type of investment is that you stay in the traditional world of finance, which is rather comfortable, underlines Vincent Boy, market analyst at the broker IG France. You just have to open a securities account – or use the one you already hold – to house financial products listed mainly in the United States, Canada, the Netherlands, Germany and Luxembourg.

A wide range of companies related to the cryptoeconomy

Buying shares directly is a financially advantageous first option because you will only pay transaction costs and, depending on the bank chosen, possible securities account management costs. Above all, there is a wide range of companies related to the cryptoeconomy. They participate in the industrial development and technological innovation of this industry. This is the case of the digital currency exchange platform Coinbase, listed in New York. Its performance is correlated to the dynamism of this market since its turnover is above all linked to the collection of commissions on the transactions of purchases and sales of cryptos. Thus, between November 2021 and November 2022, bitcoin and Coinbase stock plunged 67% and 81% respectively. On the other hand, since the beginning of 2023 (as of May 17), their prices have jumped by 60% and 64%.

Similarly, some blockchains (Bitcoin, Dogecoin, Litecoin, etc.) use mining companies, owners of ultra-powerful computer parks, to ensure the validation of their transactions. The financial results of the latter are closely linked to the dynamism of cryptoassets. Several of them are listed on the stock exchange, like American mining “farms” such as Marathon digital, Riot platforms and CleanSpark and their Canadian counterparts Hut 8 Mining, Bitfarms and HIVE Blockchain Technologies.

Manufacturers of smart cards and graphics cards such as the Americans Nvidia, Advanced Micro devices (AMD) and IBM also share interests with this sector, but in a less direct way, since they equip, among other things, the computers of mining. Finally, firms specializing in digital payment, the design and programming of algorithms, the development of cryptographic data, also play a role in the development of blockchain technologies. This is particularly the case of the Americans Block, Galaxy Digital, Bakkt and the Japanese NTT Data.

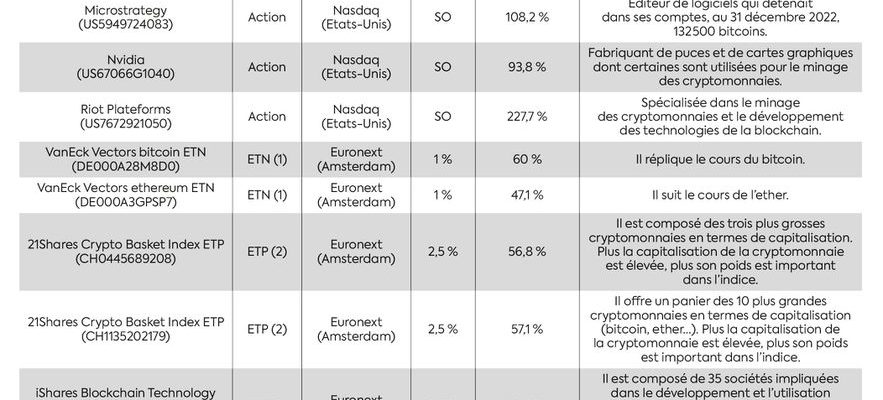

10 financial products that follow the course of cryptocurrencies

© / The Express

It should nevertheless be kept in mind that, from time to time, the price of these companies may differ from that of the cryptoassets. Especially if they are victims or actors of specific events that will influence their image and performance, negatively or positively. This therefore forces you to study the companies that you are going to integrate into your portfolio and to regularly monitor the evolution of their stock market value and their financial results.

Choose products that have proven themselves

If you don’t have the time or the inclination to select the stocks yourself, you can turn to financial products that have proven themselves over several decades. These are ETFs (exchange traded funds) and ETNs (exchange traded notes). These two types of funds aim to replicate the performance of a specific asset: the first will follow the evolution of an equity index of companies linked to the cryptosphere; the latter the performance of a specific digital currency.

Please note: some ETFs do not buy company shares directly, but trade “futures”, that is to say speculative contracts that bet on the evolution of these shares. In addition, a majority of ETNs leave their cryptocurrency stocks on deposit with a platform like Binance or Coinbase, which exposes them to the risk of hacking and bankruptcy of the platform. It is therefore important to check in the documentation made available to you that the ETF is indeed the holder of the securities and that the ETN keeps its digital currencies off-exchange or, if not, that it has taken out insurance to compensate its subscribers in the event of a problem.

Finally, if you have comfortable financial means, you can take advantage of the advantages conferred by life insurance, both at the tax level and in terms of the transmission of assets. “Although the French insurance code does not authorize the integration of crypto-assets within a life insurance contract, there is a fairly simple solution which consists of subscribing to a Luxembourg life insurance contract, specifies Guillaume Eyssette, associate director of the asset management firm Gefinéo. This can be signed from France and will be taxed in France, exactly like a French contract, with the same rules and the same advantages. You will then be able to benefit from a fund dedicated which will integrate, according to your expectations, a more or less high dose of digital currencies. But this has a price that is far from negligible. The entry ticket amounts to… 125,000 euros.