Everyone agrees to save for retirement. And the retirement savings plan (PER) has become the ideal placement to do this, even if it is not the only one (life insurance, employee savings and real estate retain their advantages). In practice, all that remains is to choose a product that performs well over time. A very difficult task because you have to face an abundant market: more than 100 PERs are on the market! To find your way, the right solution consists of starting from your saver profile, defined by your financial knowledge, your temperament (prudent? offensive?) and your aspirations. Here are five profiles, with a selection of supporting PERs.

“Newbie” profile: value for money above all

Good news ! By law, the PER directs your savings towards so-called “horizon” managed management by default. Translation: your payments are divided between equity and bond funds, or even guaranteed euro funds, all depending on your retirement deadline and your management choice (from prudent to dynamic). From there, the manager gradually secures the capital as you approach retirement.

Reassuring, is this automatic pilot effective? The PER is too young a product to analyze its performance over time. It is better to take an interest in the content of the proposed portfolio. Many PERs include long-term management made up of “in-house” funds, therefore in the hands of a management company belonging to the insurer or bank which promotes the product. “This situation often leads to high fees, or even conflicts of interest in the choice of funds,” says Sébastien d’Ornano, president of Yomoni. “We must favor independent managed management, which is more effective over time.” Two other points need to be looked at: the presence or not of a fund in euros in the management grid, this being the only support guaranteeing the security of capital over time, and the pricing of management. At more than 0.70% per year, that’s a lot to pay.

“Autonomous” profile: heading to the Internet

Independent savers will prefer to choose for themselves the financial vehicles (units of account, in the jargon) in which to invest. Any PER allows access to “free” management on request. The range of products offered must still be sufficiently diversified, with multi-management (several management companies represented) and multi-assets (shares, bonds, real estate, unlisted, etc.).

The cleaning is done quite quickly: most PERs sold by banks or traditional insurers, including mutuals, display an insufficient offer in this area. It is on the Internet that you will find the most complete formulas at a reasonable price. These contracts list dozens, even hundreds of investment funds, including real estate, unlisted funds, direct shares, etc. For an independent saver, the conditions for choosing between online management supports and tools must be analyzed in detail.

Another point to clarify: does the PER provide clear and transparent daily information on the funds, their value, their fees? “Is there also provision for multi-compartment management, allowing you to freely mix your savings between free and delegated management, or to modify your type of management?” adds Delphine Pasquier, development director at Prepar Assurance. In fact, few PERs deliver this cocktail.

“High-end” profile: priority to the quality of advice

In a PER, it is not the entry ticket which sets the “range” of the product since everyone opens with a few hundred euros. If you want more than the general public, it’s at the level of pre- and post-subscription advice that everything comes into play. Here, the contribution of a good independent wealth management advisor is interesting to optimize taxation on the PER, integrate this product as best as possible into your assets and articulate it with your objectives (retirement, transfer, etc.). So many services which will logically lead to higher costs.

The private units of banks can provide them, but their PERs often lack financial attractions. Because this is the other key element of “high end”: obtaining personalized management, called “under mandate”. In practice, you entrust the reins of your savings to a management company according to a defined profile; it is up to her to perform well. The PER wealth options should also be closely observed, particularly death guarantees and their cost.

“Eco-responsible” profile: pay attention to the packaging!

A long-term product, the PER fits well with the idea of targeted savings on the themes of sustainable development, the environment, and even the social and solidarity economy. But beware of the greenwashing that has invaded the world of finance for content that is often very hollow.

The idea here consists of using managed management (by horizon or not) including labeled funds (ISR label, Greenfin or Finansol). On the market, you will find this type of support in most PERs – it is also a legal obligation, with three funds at least -, but this is not enough to hold a 100% “sustainable” portfolio. If this is your goal, the choice will be much narrower. You will mainly have to turn to certain mutualist establishments, which have made it their hobby horse (La France mutualiste, Macif, Maif, etc.). In any case, don’t forget to look closely at the other characteristics of the PER (fees, funds in euros, associated management tools).

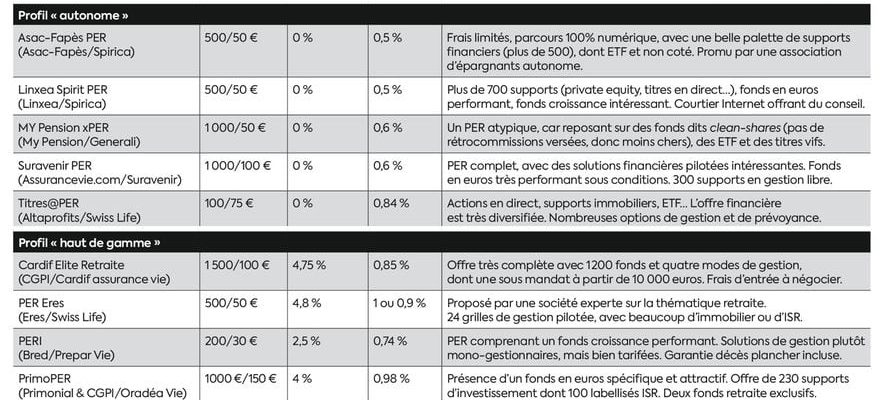

PER for each profile

© / DR

“Rentier” profile: innovations and rewards

“The French are shunning life annuities,” insurers repeat. And to recite that the current success of the PER is based on the possibility of capital exit, which was absent from former retirement products. The idea of receiving an income until one’s death in exchange for giving up one’s capital to an insurer can indeed be daunting.

However, the annuity can also be of great service to certain savers, particularly those who do not want to pass it on death. This is why some PERs offer sophisticated options, likely to improve this exit method. For example, there are annuities whose amount increases in stages; so-called “comfort” annuities with a high initial amount, which decreases after a certain age; “dependency” annuities providing an increase if you lose your autonomy, etc. Be sure to decipher the device by carefully reading the PER instructions.

.