The contribution of the most fortunate is becoming clearer. Questioned Thursday evening on France 2, Prime Minister Michel Barnier indicated that this “effort” to restore public finances would “recover 2 billion euros”. Without detailing the details, Budget Minister Laurent Saint-Martin indicated in the morning, still on France 2, that this “exceptional” and “temporary” contribution from the richest should concern around 65,000 households in France, on the 20 million households paying income tax. Or “0.3% of households”, specified the tenant of Bercy. The income levels concerned will depend on the composition of the tax household.

A taxation of the richest which could be inspired by what is done among our European neighbors. A look back at the different forms and levels of taxation on higher incomes in the rest of Europe.

Taxes dedicated to the wealthiest are becoming rare

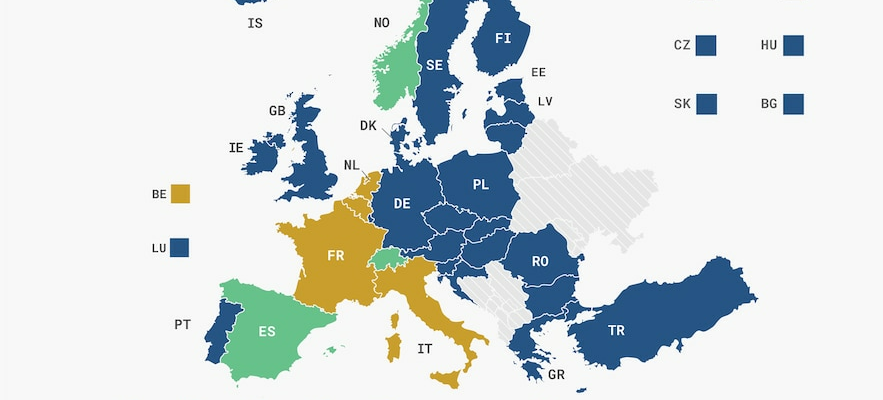

We can first look at the existence or not in European countries of a levy dedicated to the most fortunate: a wealth tax (ISF). In a publication last Februarythe American think tank Tax Foundation thus classifies the countries concerned according to two categories: States which tax only part of the wealth of the wealthiest, such as real estate or shares on the stock market, and States which tax all of their fortune.

Results of the accounts: only three countries in Europe tax wealth as a whole today. Thus, Norway has levied this tax “since 1892” according to two wealth thresholds: either a “taxation of 1% of the wealth of individuals exceeding 1.7 million Norwegian crowns” (or 145,000 euros), or “a rate of 1.1%” for net wealth “exceeding 20 million crowns” (or 1.7 million euros), specifies the Tax Foundation.

Types of wealth taxes in Europe by country (as of February 2024), according to the Tax Foundation think tank

© / Tax Foundation

We also find Spain, with “a progressive tax ranging from 0.16% […] at 3.5% of assets worth more than 700,000 euros” depending on the autonomous regions, to which is added a “tax [national] “solidarity on wealth since 2022 and 2023”, ranging from “1.7 to 3.5% for individuals whose net assets exceed 3 million euros”. Finally, Switzerland serves as the oldest ISF in Europe, with a tax on net wealth implemented for the first time “in 1840” and whose “tax rates and tax deductions vary considerably from one canton to another.

Finally, four European countries tax certain specific types of income. In addition to France and its real estate wealth tax (IFI), Italy taxes financial assets and real estate held abroad at around 1%, Belgium only taxes securities accounts of more than 1 million euros , and the Netherlands taxes the heritage at around 30% excluding main residence and certain financial assets.

Variable taxation depending on salaries or dividends

However, the existence or not of a wealth tax is not enough to compare the taxation of the richest in Europe. We must also take into account national taxes on income from work (such as wages) and capital (rent, dividends, etc.), applied to many more households but generally being progressive according to levels of wealth.

To try to see things more clearly, a study published in 2023 by the Organization for Economic Co-operation and Development (OECD) compared the taxes of the highest incomes in 2021 on an equal footing. This in fact examines “the average tax rates of single people without children earning 1 time, 3 times, 5 times or 20 times the average salary in [chacun des 38 pays de l’OCDE]and whose income is composed solely of either salaries or dividends”, reports the specialized site Public finance and economy (Fipeco).

Thus, if we limit ourselves to people earning 20 times the national average salary, the tax rate for very high salaries in France is 64%, in second place on the European and OECD podium, “behind Belgium (67% ) and ahead of Finland and Slovenia (63%),” indicates Fipeco. In the rest of Europe, the tax rate for these wealthiest people reaches 52% in the United Kingdom, 50% in Italy, and even 47% in Germany and Greece.

As for taxes on dividends for these same single people earning 20 times the national average salary, “France is in fourth place in the OECD” with a rate of 51%, tied with Switzerland, Fipeco further indicates. The country, on the other hand, places itself behind Spain (57%) and Denmark (55%), but ahead of Germany (49%), Belgium (48%) and Italy (47%).

These 2021 figures thus seem to show that France is one of the countries in Europe which taxes the highest incomes the most. However, it is also one of the countries which has the greatest gap between its taxation of salaries and dividends: there is a difference of 13 points between the two rates, “twelfth in the OECD”, against 1.1 points in Germany, 3 in Italy or 4.4 in the United Kingdom. Enough to convince French fortunes to receive dividends rather than a salary.