“Love at first sight” investments do not respond to the same motivations as traditional investments. “It’s the same thing in luxury real estate: pleasure has become a very important element over the last three to four years and this translates into specific selection criteria,” analyzes Nicolas Orlowski, CEO of the Artcurial group, which acquired John Taylor in 2017, a network specializing in exceptional real estate. Buyers with several million euros to buy a home in Saint-Germain-des-Prés, Deauville, Courchevel or on the Riviera are looking for properties in perfect condition that are immediately available, real estate agents note. The wealthiest among them are, moreover, little affected by the rise in interest rates, which limit the borrowing capacity of traditional buyers.

This specificity has allowed the luxury real estate segment to hold up well in the first half of 2024. “The market suffered a lot in 2023, with drops in activity of around 20 to 25% in Paris, but since the beginning of the year, it had recovered well, which made us optimistic for the second half, until the elections put a stop to it”, notes Richard Tzipine, CEO of Barnes. Not all players define luxury at the same level. According to a recent study by Belles Demeures, there were 9,000 transactions of more than 1.2 million euros in 2023 and 870 exceptional sales at more than 3.2 million euros. In this last area, the specialist site estimates that prices increased by 1.7% on average in France over one year to June 1, compared to -2.5% for the traditional market.

A succession of micro-markets

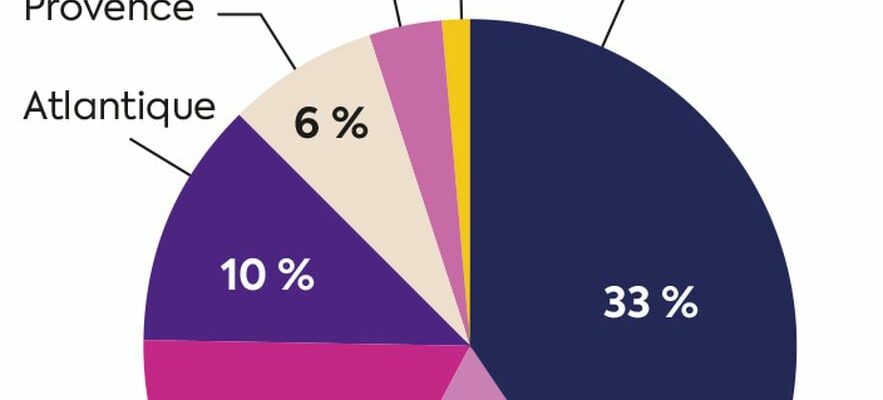

The fact remains that this market is far from homogeneous: some destinations are down, while others are stable or even up. “We can’t talk about a global market, but rather a succession of micro-markets,” says Nicolas Orlowski. “What’s complicated is that where there is supply, there is no demand, and where there is demand, there is no supply!” The same observation at Barnes, where some properties located on the Breton coast, situated in a protected massif or benefiting from a privileged view, sell in a few hours. According to Belles Demeures, however, it is in the Alps that the price increase has been the strongest over a year, with an increase of 8.1% on average, followed by Provence (+7.2%).

© / THE EXPRESS

Within the same area, significant differences can also emerge. This is particularly the case in large cities, including Paris. According to Daniel Féau, CEO of the eponymous group, “the drop in prices in the capital in 2023 and in the first quarter of 2024 has allowed the market to return to a fluidity close to normal.” But, in detail, large family apartments, mainly sought after by wealthy French households, are struggling to find takers while pied-à-terres popular with international buyers are flying off the shelves. According to Barnes, the Parisian market has seen its prices drop by 4%, all arrondissements combined, over a year. A situation that is also affecting beautiful homes in the Paris region. “After having long benefited from remarkable dynamism, sometimes greater than that of the capital, exceptional real estate in the Paris region is struggling,” points out the Belles Demeures study.

Project postponements since dissolution

Another sign of tension on the market: at John Taylor, there has been an explosion in the number of project abandonments mid-stream. “In one year, the breakage rate has more than doubled in half of the destinations for which we operate,” notes Nicolas Orlowski. It is not certain that the political climate will improve things in the short term. Foreign investors, particularly American ones, prefer to postpone their projects since the announcement of the dissolution of the National Assembly. “For seven years, France has enjoyed regulatory and fiscal stability that has attracted a lot of foreign capital, but today everything has come to a standstill,” confirms Julien Magitteri, Managing Director of Barnes Family Office by Côme. The month of September, post-Olympic Games and elections, should be decisive in determining which way the wind will turn.

.