Local household taxes fell by 18.4% between 2017 and 2023, thanks to the elimination of the housing tax on main residences, according to a note from the general budget rapporteur to the National Assembly to be published on Tuesday May 28. It concerns direct local taxes, distributed between households, businesses and administrations. Added to these are local indirect taxes (domestic consumption tax on energy products, tourist tax, etc.).

Result: property taxes, housing taxes on second homes or even those linked to garbage collection represented 37.1 billion euros in 2023, compared to 45.5 billion euros in 2017, according to this note from Jean -René Cazeneuve (Renaissance). In 2023, a French household pays on average 1,200 euros in local taxes, a reduction of 22% in current euros, the work specifies. Concretely, each French household has seen its taxes decrease by 340 euros in seven years.

And in detail? The abolition of the housing tax on main residences, completed in 2023, alone represents 17 billion euros less to pay for households. This reduction more than offsets the increase in all other local taxes over the period: housing tax on second homes (+ 40.1%), property tax (+ 30.1% on built properties, + 13.4% on undeveloped properties), household waste collection tax (+ 26.5%)… Increases which respond to an inflationary context and are also explained by the “discretionary increases” of local executives.

This money benefited the most modest French people more, recalls the note from the Macronist deputy. “42% of households rent their home. They no longer pay any local tax today and permanently,” underlines Jean-René Cazeneuve. The latter specifies that for a tenant household, the bill has decreased by almost 400 euros in seven years. As for multi-owners, the situation is a little different: despite the end of the housing tax on their main residence, they have suffered increases in property taxes on all of their properties.

Massive declines on the business side

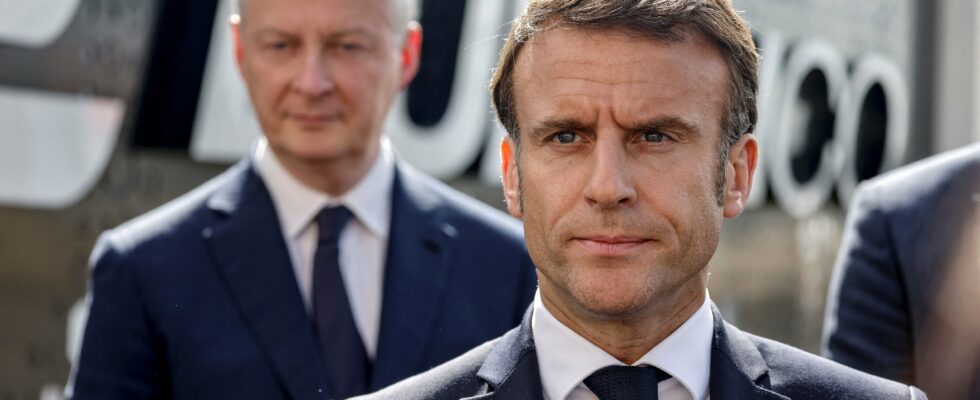

This drop is also visible in the local tax claimed from businesses, which fell by 13.2% between 2017 and 2023, bringing in 37 billion euros last year, compared to 42.7 billion euros on arrival. to the power of Emmanuel Macron. In just three years, the State has given up 24 billion euros in revenue, the report recalls.

The gradual abolition of the contribution on the added value of companies (CVAE), which must last until 2027, represents the bulk of this development, with companies not escaping, for example, the increase in the tax land on built properties (+ 11.8%). At the same time, local authorities have seen their financial situation improve, explains Jean-René Cazeneuve, thanks to financial compensation through fractions of VAT. The Court of Auditors indicated for its part in July last year, with regard to the year 2022, that the situation remained contrasted from one community to another.

If the French pay less taxes, billions will escape the state coffers. While the public deficit amounts to 5.5% of GDP, the opposition points the finger at these tax gifts. Certainly, the French’s wallets are becoming lighter, but the question remains how to fill the budgetary hole.