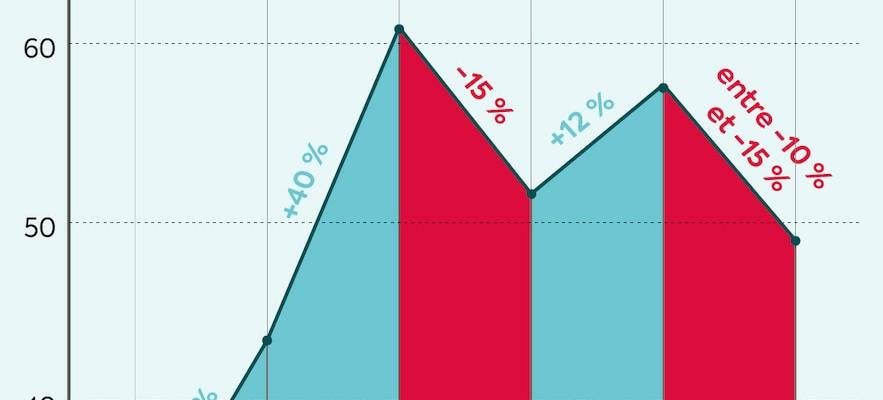

In the heart of Shanghai, like London’s Tate Modern, a converted factory hosts contemporary art exhibitions. Along the Huangpu River, in this “Power Station of Art”, a “Gabrielle Chanel” retrospective is being held until November 24, while less than 200 kilometers away, in Hangzhou, the famous label with the intersecting Cs will organize its “Métiers d’arts” fashion show in December. Also on the program these days, “L’or de Dior” is holding a salon at the Guardian Art Center in Beijing. So much effort to display the splendor of the great Parisian houses, against the current of the gloom attributed to the Chinese economy, is surprising. In fact, 2024 will not go down in the annals of luxury. Sales in China could fall by 15%, after the 12% rebound in 2023, the year when life returned to normal in the country.

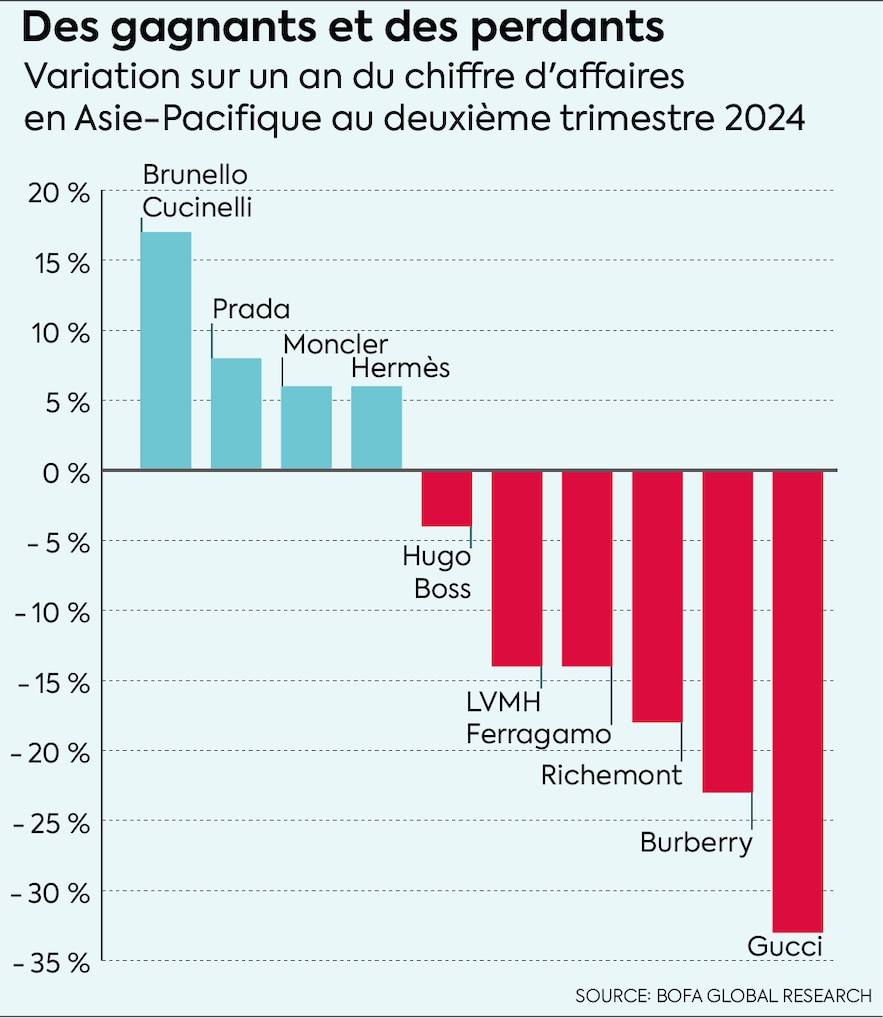

The big names are tight-lipped about precise figures. However, we know that Gucci and Burberry suffered stinging setbacks in the second quarter, marked by a drop in their turnover of more than 20%, or even 30% in Asia-Pacific. Richemont – Cartier, Van Cleef & Arpels, Jaeger-LeCoultre…- has also lost some feathers. Wealthy Chinese are stopping collecting watches – the Swiss watch industry saw its exports cut by a third in July – and are moderating their consumption of spirits. “Hennessy cognac is being penalized by weak local demand on the Chinese market,” the LVMH group acknowledged this summer, while Rémy Cointreau noted “a continued destocking of the whisky category in China.”

“The main reason is the real estate crisis”

The local consumer is also turning away from big German cars. Porsche is proving incapable of fighting the inexorable competition from Li Auto and other NIOs, in a context of merciless price wars. Deliveries by the Stuttgart firm fell by 33% in the first half of the year. “Within the same segment, a Chinese car is 25% cheaper than a European one,” notes Catherine Garrigues, head of equity management at Allianz GI. BMW and Porsche are no longer competitive. The latter had gone public by highlighting a success story Chinese which is now deflating. Based in China for about ten years, consultant Jacques Roizen notes that “Chinese manufacturers produce electric cars that look like Land Rovers, with remarkable finishes, sold for between 35,000 and 45,000 dollars. Today, I don’t know anyone who buys anything other than a Chinese electric car, including among the upper middle class.”

The end of bling-bling in Xi Jinping’s country? There is nothing surprising in this sectoral slowdown, points out Catherine Garrigues, in a slowing economy: “The main reason is the real estate crisis, a sector that had driven growth for decades.” François Chimits, an analyst at the Mercator Institute for China Studies, confirms that the property debacle explains the loss of household confidence. “Between 60 and 80% of their financial wealth is invested in real estate. However, housing prices have plummeted by around 20%, which has caused a deterioration in the wealth effect.” In other words, homeowners feel impoverished and are being extra cautious. The savings rate is now approaching 40%, a very high level. “In less than two years, bank deposits have gone from 90% of GDP to 115%,” adds the specialist. Bing Yuan, a manager-analyst at Edmond de Rothschild, noted this concern this summer in her circle of thirty-somethings living in Beijing: “Within the middle class, among employees, there is more uncertainty about employment. In tech or finance, my friends have also confided in me their little hope of getting bonuses this year, which represent a significant portion of their income.”

Spending on luxury consumer goods in China in billions of euros

© / The Express

Beyond these cyclical factors, on a deeper level, behaviors are changing, continues this financial analyst: “We are seeing a real change in preferences, particularly among young people, with more rational spending, the search for quality, innovative, different goods. Consumers no longer hesitate to analyze each product in detail. In cosmetics, for example, they study the formula of creams, find out about the effectiveness of the ingredients.” And then, after the frustrations of confinement, young people are practicing more outdoor sports, to the benefit of high-end equipment brands. When Burberry trench coats are being shunned, Italian Moncler down jackets and parkas from Canadian Arc’teryx are being snapped up.

Chanel, Hermès, Vuitton and Dior: a very select club

The venerable European luxury houses, however, continue to play the timeless card. In this very select club, Jacques Roizen, founder of the Digital Luxury Group, singles out two: Hermès and Chanel. “These groups have been able to maintain remarkable consistency in their ability to offer an exceptional product, based on unparalleled know-how and creativity. They target a very wealthy clientele, which protects them from economic fluctuations.” According to BofA Global Research estimates, they have even allowed themselves price increases of 6 to 12% in 2024. Admittedly, the saddler’s sales stalled in the second quarter. But they continue to grow, at a rate of more than 5%. “As for Louis Vuitton and Dior, they are magicians of segmentation,” adds Jacques Roizen. “In addition to seducing the most affluent consumers, they have managed to capture new fans within the Chinese middle class, thanks to more accessible products such as sneakers, without harming their brand image. This second clientele has reduced its spending on luxury goods and is focusing on Chanel, Hermès, Vuitton and Dior. It considers these types of purchases as investments and checks whether these products increase in value on the second-hand market.”

Year-on-year change in Asia-Pacific revenue in the second quarter of 2024

© / The Express

The most privileged have resumed international travel. With Japan as their favorite shopping destination. A trip to Tokyo to do some shopping quickly pays for itself, given the weakness of the yen – the currency has fallen by 30% against the renminbi since 2019. Hermès Oran sandals are 9% cheaper there than in Beijing, Vuitton’s Neverfull bag or J’adior slingback pumps, with a discount of 11%. This opportunistic window shopping was in full swing in the first half of the year. Saint Laurent (Kering) saw its Japanese sales jump by 42%. LVMH speaks of “double-digit growth” in the archipelago. Generally speaking, “luxury goods sales in Japan jumped by 49% in the second quarter, largely thanks to the Chinese”, confirms Gillian Diesen, manager at Pictet AM. Rather than just domestic data, it is better to monitor the overall spending of the Chinese population in this segment. At worst, this could decline by 8% this year and, at best, increase by 4% compared to 2023, estimates Jacques Roizen.

Experts are unanimous: a resurgence in growth will make bank cards burn, especially at the highest levels. However, the Party does not seem ready to give ground. “Fiscal stimulus measures are supposed to come into effect in September, but there is little chance that they will promote consumption,” laments François Chimits. Why? “The first hypothesis is that Xi’s political orientation reflects a vision of the economy focused on the techno-industrial capacities of strategic sectors, for geopolitical purposes, with Taiwan or even the United States in its sights.” The consumer has no place in this project. The second answer, less anxiety-provoking, is ideological in nature. After all, he recalls, “in the Marxist vision, consumption is a bourgeois luxury with limited interests.” We had almost ended up forgetting it.

.