The picture darkens a little. The French economy should benefit from renewed growth in 2023 thanks to dynamic exports in the spring, but its progress will be slowed down in 2024 and 2025 by a sluggish global economy and more expensive oil, indicated on Monday September 18, the Bank of France.

These new forecasts from the monetary institution also underline that inflation should continue to decline until 2025, stemmed by the unprecedented increases in interest rates by the European Central Bank (ECB). Thursday, September 14, the board of governors, meeting in Frankfurt, decided for the tenth time in a row in more than a year, that the European institution would raise its interest rates, bringing them to a new record. Final objective: 2% inflation.

After an increase of 2.5% last year, gross domestic product (GDP) should grow more than expected in 2023, by 0.9% compared to 0.7% anticipated so far thanks to a good second quarter. This is close to the 1% increase expected by the government. Growth is expected to remain at 0.9% in 2024 (compared to 1% previously expected) then grow by 1.3% in 2025 (compared to 1.5%), slowed in its momentum by a more difficult global economy, particularly due to difficulties in Germany and China which would weigh down French exports.

However, household consumption should regain strength, in an environment where inflation is falling. “The French economy would therefore manage to gradually emerge from inflation without recession, even if an unfavorable international context would weigh on the recovery,” indicated the Bank of France. France would fare well compared to Germany, a heavyweight in the euro zone which should end up in recession this year, according to most forecasts. Berlin continues to suffer from sluggish demand and high energy costs.

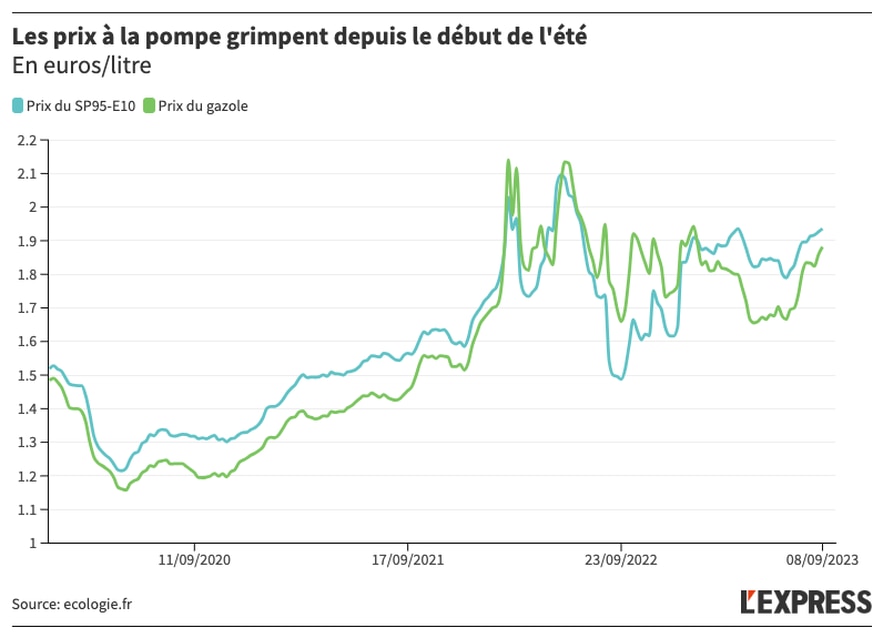

The ECB wants to bring inflation down to 2%

© / The Express

Return of inflation

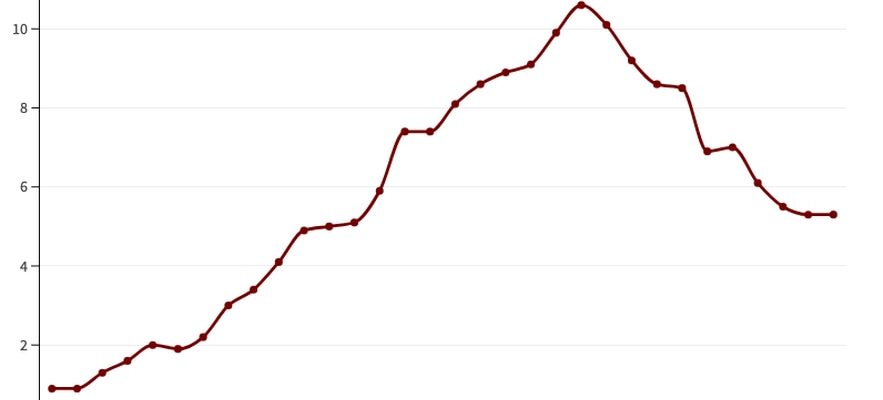

Inflation would reach 5.8% on annual average in 2023 and 2.6% in 2024, a slower decline than expected due to a rise in oil prices, Saudi Arabia and Russia having voluntarily reduced their offer. In August, Riyadh extended its supply reduction by 1 million barrels per day. According to the Banque de France, this increase in energy prices is however “out of all proportion” with the tensions which accompanied the post-Covid rebound and the Russian invasion of Ukraine. Its effects would be “temporary”. Inflation would fall to 1.8% in 2025 – measured according to the harmonized consumer price index (HICP) allowing comparison between European countries.

“We are on the path to defeating inflation, without causing recession or massive unemployment,” welcomed the governor of the Bank of France, François Villeroy de Galhau in the newspaper The cross. But “to cure this disease, we must know how to be tenacious about the remedy which is interest rates: we will therefore maintain those of the ECB at their current level of 4% for as long as it takes.”

In the meantime, to cool prices at the pump which have started to rise again to around 2 euros per liter and which affect motorists’ wallets, the government has said it wants to allow from “the beginning of December” the resale of fuel at a loss for a period of six month. “This is a possible avenue, alongside the monitoring of refiners’ margins,” estimated François Villeroy de Galhau. He judged these options “preferable to the return of a rebate at the pump which […] would be unnecessarily expensive” to already degraded public finances.

Oil prices have increased significantly

© / The Express

Unemployment rate to rise next year

Less inflation also means more purchasing power for households. The latter would also benefit from salary increases and support from the electricity price shield, which will however gradually disappear. Thus, household consumption would record a clear acceleration after stagnating (0%) in 2023: it would increase by 1.8% in 2024 and 1.5% in 2025. After reaching peaks, the savings rate would finally decrease, but without returning to its pre-Covid level.

Their investments, especially in construction, would however remain in the red, unlike those of companies which would resist. Reacting with a delay to the economic slowdown observed since the end of 2022, the unemployment rate should gradually rise to 7.8% in 2025 (compared to 7.3% in 2023), remaining however below its pre-Covid level. “We are emerging from what was the number one French disease for 40 years: mass unemployment,” underlined François Villeroy de Galhau. “Reaching full employment, that is to say going from 7% to less than 5% unemployment, cannot be immediate due to the current slowdown. But it is realistic within a few years,” a- he added about the objective targeted by the government by 2027.