(Finance) – The stock is under pressure Grouponwhich exhibits a negative percentage change of 36.41%.

The discount coupon platform has announced a new issue of shares worth $80 million, while admitting that its business continues to face challenging conditions.

The Chicago company also lifted the veil on its third quarter accounts which show a loss equal to 41.4 million, ($1.31) per share, reduced compared to the 56.2 million ($1.86 per share) recorded in the same period last year. THE revenues they instead fell from 144.4 to 126.5 million dollars, against the consensus of 129.7 million.

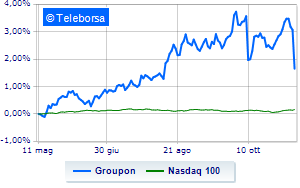

The technical scenario seen in one week of the stock compared to the index Nasdaq 100highlights a slowdown in the trend of Groupon compared toUS technology stock indexand this makes the stock a potential selling target for investors.

For the medium term, the technical implications assumed by Groupon they are still read in a positive light. The short-term indicators highlight a slowdown in the push phase in contrast with the price trend so, at this point, the marked slowdowns in the revaluation phase approaching USD 9.54 should not be surprising. The most immediate support is estimated at 8.054. Expectations are for an adjustment phase aimed at eliminating medium-term excesses and ensuring an adequate turnover of the operating currents with a target of 7.497, to be reached in a reasonably short time.