(Finance) – Positive opening for the New York Stock Exchangewith i hikes in tech stocks pushing the Nasdaq up. The performance of Netflix, which benefits from investor William Ackman buying 3.1 million shares, saying the streaming giant’s recent sell-off represented an attractive buying opportunity. Tesla, despite the positive quarter, suffers from the fact that it has communicated that the supply chain problems will last throughout 2022.

Day full of significant macroeconomic data. The preliminary GDP estimate for the fourth quarter of 2021 was higher than expected, while requests for unemployment benefits have returned to decline, after the increase in recent weeks resulting from the spread of the Omicron variant. Durable goods orders fell slightly in December.

On the front of the quarterly announced in the pre-market, McDonald’s it disappointed market expectations both in terms of revenues and profits, due to the increase in costs. Labor shortages and supply chain problems have hit the accounts of Northrop Grumman. Blackstone posted record earnings in the fourth quarter of 2021. MasterCard it exceeded Wall Street expectations, with customer spending rising both domestically and in cross-border volumes.

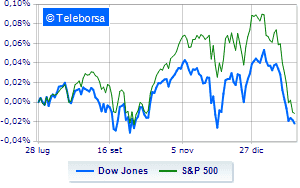

The Dow Jones advances to 34,443 points; on the same line, theS & P-500 it gained 0.91% compared to the previous session, trading at 4,389 points. Good performance of the Nasdaq 100 (+ 0.81%); as well, rising theS&P 100 (+ 1%). Positive result in the S&P 500 basket for i sectors power (+ 2.19%), materials (+ 1.75%) e consumer goods for the office (+ 1.29%).

Between protagonists of the Dow Jones, DOW (+ 5.30%), Microsoft (+ 1.92%), Nike (+ 1.83%) e Chevron (+ 1.73%).

The strongest sales, on the other hand, show up on Intelwhich continues trading at -5.56%.

Sales focus on McDonald’swhich suffers a decline of 1.29%.

Between best performers of the Nasdaq 100, Seagate Technology (+ 18.95%), Xilinx (+ 7.26%), Netflix (+ 5.64%) e Tractor Supply (+ 4.15%).

The strongest sales, on the other hand, show up on Garminwhich continues trading at -10.69%.

Sensitive losses for Inteldown 5.56%.

Breathless Lam Researchwhich falls by 4.99%.

Thud of Comcastwhich shows a drop of 4.91%.