FUEL COMPENSATION REQUEST. The new fuel allowance for the year 2023 was announced and launched on Monday January 16, 2023. To obtain it, you must complete a file with the tax authorities. Are there documents to provide, what references should I enter? We tell you everything!

Access the fuel compensation claim form on impots.gouv.fr

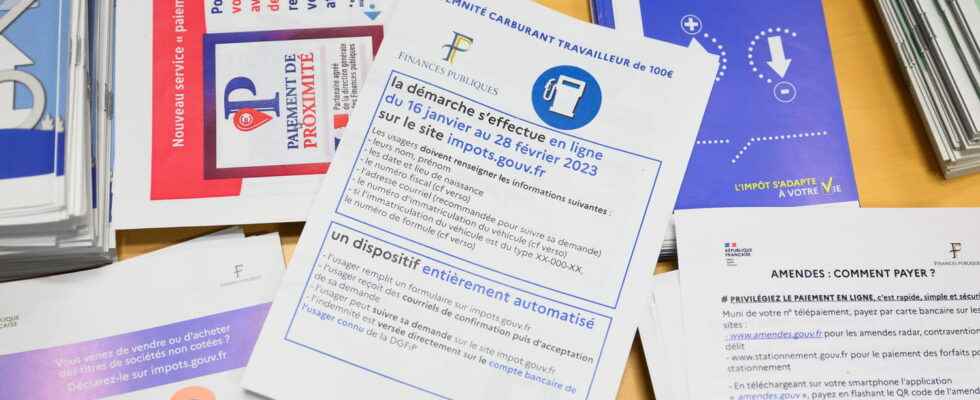

[Mis à jour le 17 janvier 2023 à 13h38] More than 250,000 people had completed their fuel compensation application file in a few hours on Monday, the day of the launch of the online form for this new aid announced by the government for the year 2023. Do you want to apply? The methods of obtaining are specified on the tax site on the following page: https://www.impots.gouv.fr/indemnite-carburant-de-100-eu-comment-ca-marche. This page also provides access to an online form to fill out a fuel compensation claim file. A specific page has been created on the tax website. It also refers to the online application form or allows you to view the progress of the file if it has already been submitted. To access it, nothing could be simpler with Linternaute.com, just click on the button below!

Access the fuel indemnity claim form

What documents are required to complete your fuel compensation claim file?

Be aware that the fuel allowance requires two types of documents, one concerning your tax situation, the other allowing you to verify that you have a personal vehicle. For this, the tax authorities will ask you to provide online when submitting your file:

- your tax number, available on your tax notice, whether for income taxes, housing tax or property tax or on your last income tax return. You can find it at the top left of the document.

- the registration number of your vehicle present on your gray card. If the registration is in the form XX-000-XX (two letters followed by three numbers and two letters), the formula number must be indicated. It is to be found at the bottom left of the gray card.

- Finally, if you wish to be kept informed of the progress of your file, fill in an email address. It will allow the tax authorities to inform you that your request has been taken into account and then, if your file is valid, of the next payment of the indemnity.

How much and when?

The amount of the fuel allowance was set at 100 euros in 2023, paid by transfer to the bank account indicated to the tax authorities in the context of income tax. The transfer will appear in the form “INDEMN.FUEL”. No payment date has been officially indicated. On the other hand, a deadline for submitting the file has been formalized: you have until February 28 to make your request for fuel allowance.