When one conflict fuels another. Attacks by Houthi rebels have continued without weakening in the Red Sea since the end of November 2023. The latter claim to only target ships trading with Israel, and thus act in solidarity with the Palestinians faced with the war between the State and Hamas in the Gaza Strip.

Again this week, off the coast of Yemen, a new missile strike hit a Greek bulk carrier flying Maltese on Tuesday. An American cargo ship was also targeted on Monday January 15 in the Gulf of Aden by a similar shot.

Problem: these attacks are increasing in the area of the Bab al-Mandeb Strait, which controls access to the southern Red Sea, where around 12% of world maritime trade passes. Since mid-November, the number of containers has fallen by 70%, according to maritime experts.

Two ships hit by Houthi missiles in Red Sea

© / afp.com/Paz PIZARRO, Sylvie HUSSON

Alternative route to the Cape of Good Hope

Many shipowners preferred to interrupt their traffic in this area. Thus, this Wednesday, three of the main Japanese maritime carriers confirmed that they were suspending the transit of all their cargoes through the Red Sea, due to tensions in this region, in order to “guarantee the safety of the crews”.

A similar decision was taken by certain large oil companies (BP, Shell, QatarEnergy) and maritime transport companies (MSC, Maersk, Hapag-Lloyd, CMA CGM, etc.) which, for several weeks, have wanted to avoid the Red Sea until further notice. order.

Many companies appear to be opting for an alternative route around the South African Cape of Good Hope to connect Europe to Asia. Thus, carriers have diverted “more than 200 billion dollars of goods” to this area, specifies the American financial television channel CNBC.

According to data from Flexport, a logistics specialist, “the share of ships which have chosen to pass through the Cape of Good Hope instead of the Suez Canal has increased from 13 to 85% since the end of November”, can we read in the German economic daily, Handelsblatt. But this detour of some 6,000 kilometers extends delivery times by around ten days on average.

To add to the difficulties, another region of the world is affected, this time by climate risks. The drought affecting the Panama Canal has significantly slowed down the transit of ships between Asia and the United States. While normally around forty container ships pass through it every day, this figure was reduced in mid-January to 24 daily passages.

Production shutdown and delivery delays

As a result, several companies have already announced delays, like the Swedish furniture giant Ikea or certain automobile manufacturers. In Germany, as the daily Handelsblatt reports, “it’s at Tesla, in the [land du] Brandenburg, let this be seen most clearly so far: the incessant attacks by Yemeni Houthi militias on commercial convoys in the Red Sea are affecting the German economy.”

On January 11, the American electric car manufacturer stopped production at its Gigafactory in the north of the country “for two weeks due to delivery difficulties”. The Volvo factory in Ghent (Belgium) was also due to be closed for three days in mid-January due to a lack of gearboxes, the delivery of which was delayed due to “readjustments in maritime routes”.

Finally, the transport of liquefied natural gas (LNG) “will be affected” by the escalation in the Red Sea, Qatar Prime Minister Mohammed bin Abdulrahmane Al-Thani said on Tuesday at the World Economic Forum in Davos.

Inflationary threat

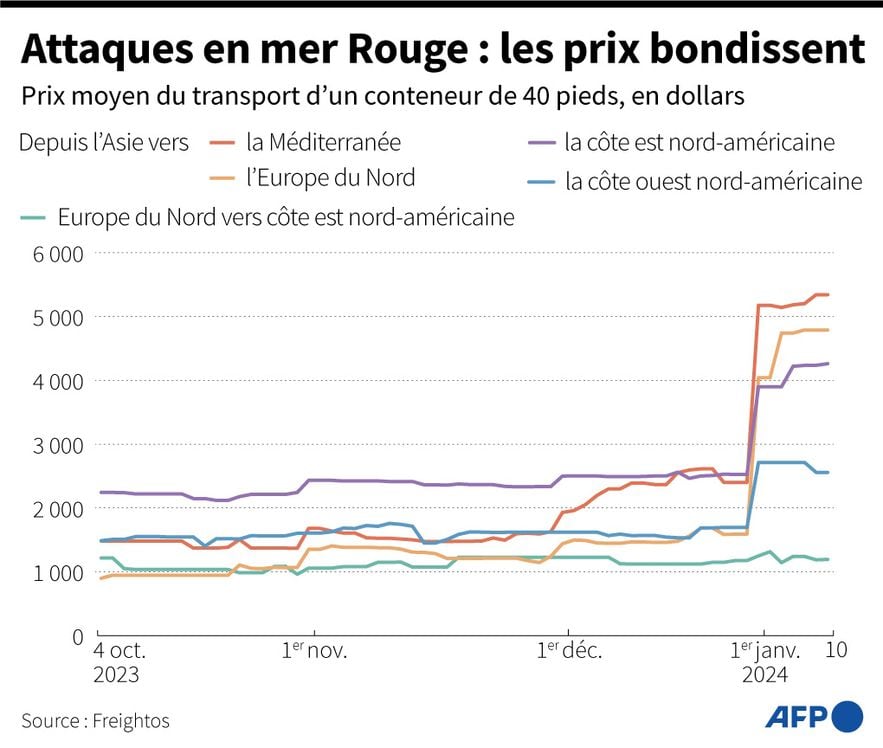

The consequences are irremediable on prices: shipping companies have made significant price increases to cover the costs linked to the crisis. One of the benchmark indicators for measuring the freight cost of goods transported from China, the Shanghai Contained Freight Index (SCFI), has more than doubled in one month.

Attacks in the Red Sea: prices jump

© / afp.com/Kevin TRUBLET

The additional cost in terms of fuel is around 20%, according to the logistics platform Container xChange, which estimates that the crisis in the Red Sea could increase maritime transport costs by 60%, with an additional premium of around 20 % for shipowners’ insurance.

This raises the specter of renewed inflation. These fears were assessed by the international firm Oxford Economics at an additional 0.7 point of global inflation at the end of 2024, “in the hypothesis that “the Red Sea were closed to boats for several months and that shipping costs transport remained around twice the December price”. Everything will therefore depend on the duration of the crisis.