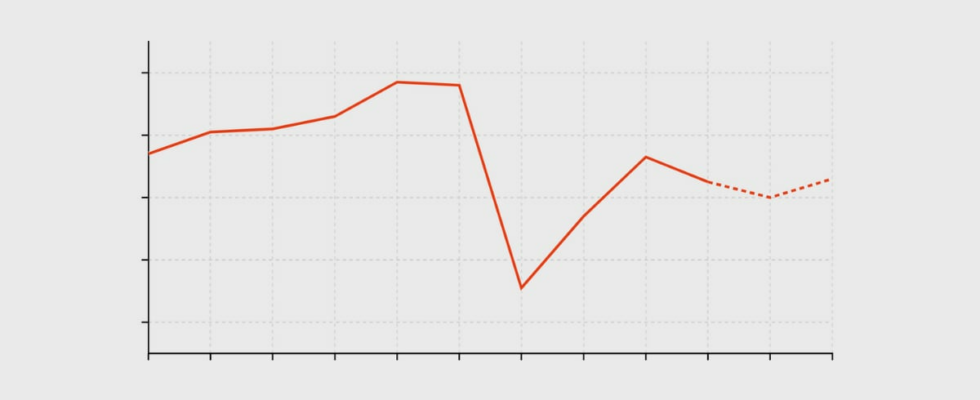

“The skid of the public deficit for two years has placed France at the foot of the wall,” worries the Court of Auditors in its first report of the year 2025 dedicated to all public spending and made public this Thursday, February 13. Since 2022, the gap between these expenses and the sums collected by the State via compulsory samples is widening. It would thus reach 6 % in 2024 against “only” 4.8 % two years earlier.

Several phenomena explain this degradation of the public balance. First, the downward revision of growth: each time, the budget voted in the fall overestimated the increase in GDP and therefore the amount of final tax revenue. In addition, the Court highlights an increase “from the heart of public expenditure” which progresses “significantly faster than growth”.

At the origin of this drift? The report points to an explosion of social protection spending – “overcoming the national objective of health insurance expenditure”, “a deterioration in the accounts of the Unédic due to the deterioration of the labor market” but also “revaluation pensions “to compensate for a past inflation period. It also questions local communities, whose operating expenses increased by 2.6 % between 2023 and 2024.

On the other hand, these drifts of expenses compared to budget forecasts would be the cause of an increase in the deficit of almost 1 % GDP between 2022 and 2024, the rest being partly caused by exceptional expenses due to the geopolitical context and energy for example.

For the moment, the government relies on a public deficit at 5.4 % for the year 2024. It has also set itself the objective of returning to the criteria of Maastricht by 2029 – in this case, that would mean returning below 3 % public deficit.

The risks of too high deficit

Correcting the trajectory is an imperative. Today, French public debt corresponds to around 112 % of French GDP. His charge on public spending, that is to say the amount of interest that the French State must reimburse each year, is currently its second expense post, just behind the budget of National Education … and things could quickly get worse.

With a public deficit as important as that of the last two years the Court of Auditors anticipates an increase in debt to around 125 % of GDP. At such a level, borrowing rates could also increase, aggravating the burden of this debt which could reach 3.4 % of GDP (or around 112 billion euros). It is more than twice the budget of National Education in 2023; More than eleven times that of justice.

To remedy this, the administrative jurisdiction notes that the budget adopted late exclusively rests the reduction of the deficit on “increases in compulsory levies rather than overall economies”. If these recovery objectives are not maintained, France risks winning its partners from the euro zone who are already all “from a perspective close to the return of the deficit under the 3 %” threshold.