(Finance) – The stock is under pressure Ford Motor, which trades with a loss of 2.11%. The Dearborn giant has announced a price cut for its Mustang Mach-E electric SUV in response to the cuts applied by rival Tesla. Production of the SUV will increase to 130,000 units annually.

In detail, the Ford automaker said it will lower the price of the Mach-E, comparable to Tesla’s Model Y, by about $4,500, depending on the model, with reductions ranging from $600 to $5,900. Mach-E production is expected to increase from 78,000 to 130,000 units annually, and the Mexico plant will be expanded to meet the new goals.

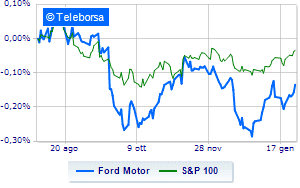

The comparison of the title with theS&P 100on a weekly basis, shows the greatest relative strength of Ford Motor compared to the index, highlighting the concrete attractiveness of the stock by buyers.

Signs of strengthening for the short-term trend with most immediate resistance seen at USD 13.14, with current stage controlling support level estimated at 12.91. The balanced bullish strength of Ford Motor it is supported by the upward crossing of the 5-day moving average over the 34-day moving average. Due to the technical implications assumed, we should see a continuation of the bullish phase towards 13.37.