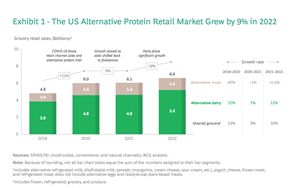

(Finance) – Alternative proteins, ie those of non-animal origin, continue the race to conquer the market. According to the BCG report “Taking Alternative Proteins Mainstream”, their potential is undeniable: increasing their share globally from the current 2% to 8% by 2030 could lead to a reduction of CO2 emissions equivalent to decarbonising 95% of the aviation industry. However, a consumer-centric approach is key to growing this new industry in the long term. In 2022 the US retail market for alternative proteins grew by 9% and sales of alternative dairy products increased by 12%, growing faster than those of their traditional counterparts (+10%); refrigerated plant milk saw sales increase by 8% and the spread category, such as alternative margarine, grew by double digits after the 2021 contraction.

The alternative meats they are also becoming a fixture in fast-food restaurants around the world: a crucial channel because it creates the opportunity for consumers to try new products, thus driving retail purchases. In fact, it was in this context that they were born partnerships like the one between McDonald’s and Beyond Meat (now discontinued) or between Burger King and Impossible Foods, with the goal of making 50% of the food chain’s menu plant-based by 2030. Nonetheless, after the explosive figures recorded in 2019 and 2020 (which saw a 25% increase in retail sales), the sales of alternative meat decreased by 0.4% in 2022against a 8% increase in traditional meat. The deceleration of these green products was predictable, since – the report reads – 2020 was an anomalous year, with retail sales inflated by the effects of COVID-19. The decline recorded in the last year is mainly due to a 14% contraction in volumes of refrigerated alternative meat compared to the previous year, despite this having achieved a revenue increase of 6%, given the price increase that the companies have carried out to compensate for the decrease in units sold.

“The current market context, characterized by price increases and cost inflation, has slowed down the growth of retail sales of alternative meats, because not all consumers are willing to pay a premium for this type of product – he explains Lamberto Biscarini, managing director and senior partner of BCG –. Product concerns also remain a focus of consumers, who feel that there is still room for improvement on things like taste and texture. To achieve large-scale adoption, the industry will need to work on this scale and try to achieve parity with traditional meat.”

Innovation is therefore necessary, above all because, according to the results, i benefits that alternative meat products offer already today they are not always appreciated by consumers: in making decisions about food, only 20% of them base their purchasing choices on sustainability issues, while 60%, i.e. the mainstream segment, although concerned about the sustainability of the food chain , is influenced by other needs. This is an important element in order to bring the consumption of green proteins on a large scale.

From one BCG and Blue Horizon research based on Instagram social listening data collected on over 300 US consumers, it was found that i Main criteria for purchasing alternative proteinand are the taste and nutritional value. The data showed that the spontaneous associations in consumers between words related to taste and health with alternative meat decreased by 5% and 3% respectively from 2021 to 2022. There are therefore perception barriers in consumers, on which companies can work by optimizing communication.

Through the principles of behavioral science, BCG has identified four actions to be implemented: the first two can be implemented quickly by all companies, while the other two depend on the occasion of use of the products. Restrict “vegan” and “vegetarian” mentions on packaging, because they can create a psychological barrier in traditional consumers. It is advisable to replace them with “contains no animal derivatives” or “suitable for a vegan diet” – this way the product will continue to be informative without deterring omnivores. Next to the wording “plant-based” is useful to specify the protein source of the product, to generate consumer familiarity, overcoming the idea that alternative meats are excessively processed or artificial. Give space on the packaging to the sensory side of the alternative meat: as with traditional products, companies should communicate to consumers the positive aspects related to the taste and texture of the products, using, for example, terms such as “flavorful” or “simmered”. Brands can also combine this language with vibrant and enticing imagery. This solution is particularly important when addressing consumption occasions where desirability is the primary need of consumers. When marketing a product that has a desirable nutritional profile and that caters to a health-promoting occasion, emphasize health benefits on packaging can have a certain resonance with consumers. Only 56% of the 25 most famous alternative meat brands apply at least 2 of these 4 principles and, not surprisingly, the growth rate of these brands since 2019 is 6 times higher than that of competing companies that have not yet implemented them .

The BCG study then points to others concrete actions that companies can take to build long-term market share. First of all, it is necessary to understand who mainstream consumers are and what they need in the various occasions of use of the product, but also to innovate products based on alternative proteins to improve their taste, texture and price. It therefore becomes necessary to carry out tests that make it possible to simulate consumer behavior in the real world and adopt a continuous learning approach, refining both the products and the communication linked to them. Alternative dairy products have shown that the transition to the mainstream is possible: it is time for the alternative meat sector to seize this opportunity too.