(Tiper Stock Exchange) – Downside session for the main stock exchanges of the Old Continent. Instead, the square of Milan holds, which stops on the parity line. Be wary of the Wall Street stock exchange, where theS&P-500 marks a +0.02%, on the day in which the president of the Federal Reserve, Jerome Powell has not provided further information on interest rates. Speaking in Sweden, the banker did not address the issue of the US central bank’s next monetary policy moves, while the markets expected to understand the validity, or otherwise, of the expectations of a less aggressive Fed on the cost of money.

On the foreign exchange market, theEuro / US Dollar it closed the session on the previous day’s levels, reporting a change of -0.04%. L’Gold maintains substantially stable position at 1,873.1 dollars an ounce. Light Sweet Crude Oil was up slightly, advancing to $75.18 per barrel.

Go back down it spreadssettling at +190 basis points, with a drop of 7 basis points, while the yield on the 10-year BTP stands at 4.19%.

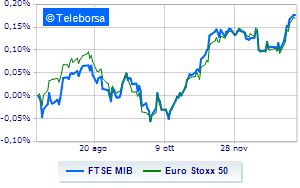

In the European stock market scenario colorless Frankfurtwhich does not record significant changes, compared to the previous session, disappointing London, which lies just below the levels of the vigil; sluggish Paris, which shows a small decrease of 0.55%. Stabile Piazza Affari, which archives the session on the levels of the eve with the FTSEMIB which stops at 25,365 points, while, on the contrary, a positive performance for the FTSE Italia All-Shareending the day up 0.92% on yesterday’s close.

The value of trades in today’s session in Piazza Affari was equal to 2.14 billion euros, with an increase of no less than 522.9 million euros, equal to 32.28%, compared to the previous 1.62 billion; while the volumes traded went from 0.55 billion shares in the previous session to today’s 0.8 billion.

Between best performers of Milan, in evidence Phinecus (+1.17%), Italian post (+1.17%), Intesa Sanpaolo (+0.96%) and Iveco (+0.87%).

The worst performances, however, were recorded on Monclerwhich closed down -1.48%.

Modest descent for Campariwhich drops a small -1.28%.

Thoughtful Prysmianwith a fractional decline of 1.26%.

He hesitates Ferrariwith a modest drop of 1.16%.

Among the protagonists of the FTSE MidCap, SOL (+4.23%), Saras (+3.24%), Tinexta (+1.94%) and Luve (+1.76%).

The strongest declines, however, occurred on Drywhich closed the session at -3.78%.

MPS Bank drops by 3.49%.

Decided decline for Juventuswhich marks a -3.31%.

Under pressure GV extensionwith a sharp drop of 2.94%.

Between macroeconomic variables heavier:

Tuesday 10/01/2023

00:30 Japan: Real household expenditure, monthly (exp. -0.5%; prev. 1.1%)

08:45 France: Industrial Production, Monthly (exp. 0.8%; previous -2.5%)

4:00 pm USA: Inventories wholesale, monthly (exp. 1%; prev. 0.6%)

Wednesday 11/01/2023

10am Italy: Retail sales, monthly (previously -0.4%)

10am Italy: Retail sales, yearly (previously 1.3%).