The Russian invasion is, of course, a human tragedy and a political crisis. However, it also has far-reaching effects on the price of energy and food, for example. We put together five graphics on the effects of the war.

First and foremost, the human side.

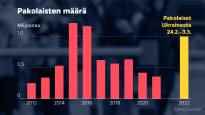

One million people have now fled Ukraine to neighboring countries in a short time (3.3.). The United Nations High Commissioner for Refugees (UNHCR) estimates that four million Ukrainians may seek refuge.

That’s a wild figure compared to previous years. According to Eurostat, 355,960 people applied for asylum in Europe last year by the end of October. The whole number last year is probably at the same level as the previous year.

They will therefore not necessarily appear in the statistics of asylum seekers, especially if the EU implements a temporary protection procedure that gives Ukrainians a temporary residence and work permit.

Many direct economic effects have already been seen: raw materials are becoming more expensive, supply difficulties are increasing and stock prices are falling.

In Frankfurt, for example, the stock market index has become soaring down. Rates are still higher than in March 2020, after the coronary pandemic hit. A similar curve is drawn from the index of the Helsinki Stock Exchange.

As Russia is either the second or third largest producer of crude oil in the world, depending on the year under review, its war will affect energy prices.

Here, for example, a graph of the price fluctuations of Brent and Urals crude oil shows how crude oil prices rose rapidly as the crisis unfolded. On the other hand, the interest rate pandemic reduced consumption in the spring of 2020, when prices also fell sharply.

The share of countries in exports is even higher: Russia is the largest exporter of wheat, Ukraine the fifth largest. The countries’ war has therefore affected the world market price of wheat even before the harvest season. It has unfortunate consequences for food security, especially in poor countries.

The price of wheat also showed a strong corona pandemic. The pandemic caused the people to hoard pasta and flour, the cargo was disrupted – and in many countries there was a drought and bad harvests.

Rising energy and food prices are also affecting inflation. Central banks could raise key interest rates so that citizens would consume less, save more and rise in prices would slow down. And then interest rates on mortgages and consumer credit will rise.