(Finance) – Shine Fiskerwhich changes hands with an increase of 27.15%.

The news released by the electric car manufacturer of an increase of over 300% in deliveries in the last quarter of the year contributes to assisting the shares. Fisker said it has delivered approximately 4,700 electric vehicles (EVs).

“In 2023, we started generating revenue, but we also encountered a number of obstacles. The consequences of Covid-19 posed several challenges to our supply chains, but we were able to resolve most of them,” said CEO Henrik Fisker . “I look forward to a year filled with new accomplishments and perspectives for the Fisker brand and everyone on our team,” said Fisker.

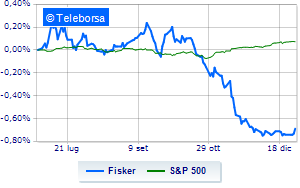

On a weekly basis, the stock’s trend is more solid than that ofS&P-500. At the moment, therefore, the appeal of investors is aimed more decisively at Fisker compared to the reference index.

The medium-term picture of Fisker reiterates the negative trend of the curve. In the short term, however, we glimpse the possibility of a timid bullish trend that meets the first resistance area at USD 2.033. First support identified at 1.713. The presence of any positive cues favors an upward movement with a target of 2.353.