(Finance) – Ferrari announced that he has purchased on Euronext Milan (EXM) and on the New York Stock Exchange (NYSE), as part of the sixth tranche of the buy-back program announced on 3 March 2022, from 9 to 13 May 2022, a total of 163,736 ordinary shares at the average unit price of € 181.6263, for one countervalue equal to 29,738,765.43 euros.

From the announcement of the Sixth Tranche of the buy-back program of March 3, 2022 until May 13, 2022, the total consideration invested was:

• 99,999,990.00 euros for no. 527,592 ordinary shares purchased on the EXM (equal to the totality of the Sixth Tranche to be executed on the EXM market, as announced on March 3, 2022)

• 20,790,699.01 USD for no. 109,354 common shares purchased on the NYSE

As of May 13, 2022, Ferrari therefore held 11,065,151 ordinary treasury shares equal to 4.30% of the total issued share capital including ordinary shares and special shares and net of shares assigned under the Company’s share incentive plan.

From 1 January 2019 to 13 May 2022, the prancing horse of Maranello repurchased a total of 5,945,433 treasury shares on the EXM and NYSE, excluding the transactions relating to Sell to Cover, for a total consideration of 922,808,190.11 euros. .

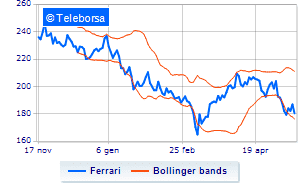

On the Milanese price list, today, a discount for Ferrariwhich records the session in sharp decline, showing a loss of 3.48% on the previous values.