(Tiper Stock Exchange) – Ferrari reported that he has purchased on Euronext Milan (EXM) and on the New York Stock Exchange (NYSE), from 6 to 10 March 2023, a total of 37,785 ordinary shares at the average unit price of 251.6737 euros, for one counter value equal to 9,509,490.34 euros.

These purchases took place as part of the treasury share buyback program of 200 million euro announced on 1 December 2022, as the second tranche of the multi-year treasury share buyback program of approximately 2 billion euro to be carried out by 2026 in line with the information provided during the 2022 Capital Markets Day (the “Second Tranche”).

From the start of this Second Tranche until 10 March 2023, the total invested consideration was:

• 79,168,368.77 euros for no. 351,648 ordinary shares purchased on the EXM

• 16,293,414.59 USD for no. 68,715 shares of common stock purchased on the NYSE

As at 10 March 2023 Ferrari therefore held 12,247,992 ordinary treasury shares equal to 4.77% of the total issued share capital including ordinary shares and special shares and net of shares assigned pursuant to the Company’s stock incentive plan.

From July 1, 2022 to March 10, 2023, the Company repurchased a total of 1,194,100 treasury shares on the EXM and NYSE, including the Sell to Cover transactions, for a total consideration of €245,263,564.94.

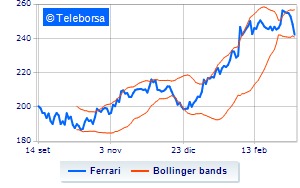

Today, on the Milanese price list, a reduction for the prancing horse of Maranellowhich closed the session with a drop of 2.46%.