(Finance) – Ferrari announced the intention of initiate a share buyback program of Euro 150 millionas the initial tranche of the new multi-year treasury share purchase program of approximately € 2 billion to be executed by 2026 in line with the information provided during the Capital Markets Day of 2022.

There First Tranche will start on 1 July 2022 And will end by November 30, 2022 and will be financed through the Company’s available liquidity. The ordinary shares repurchased as part of the First Tranche may be used to meet the obligations deriving from the Company’s equity incentive plan.

The First Tranche consists of two parts.

Firstly, Ferrari has entered into a non-discretionary contract for the purchase of treasury shares for an amount equal to € 120 million to be executed on the EXM market through a leading financial institution, the “Bank” which will adopt its trading decisions independently of and without no conditioning by Ferrari Under this contract, purchases can continue during Ferrari’s closing periods pursuant to the Regulations.

Secondly, Ferrari intends to enter into a further mandate with a leading financial institution up to a maximum of € 30 million to be executed on the NYSE. Under this mandate, Ferrari would provide the financial institution with purchase instructions from time to time in accordance with applicable rules, regulations and legal requirements. The actual timing, number and value of the common stock repurchased on the NYSE will depend on several factors, including market conditions and general business conditions.

The First Tranche enforces the resolution approved by the Shareholders ‘Meeting of 13 April 2022 which authorized the purchase of up to a maximum of 10% of the Company’s ordinary shares for a period of eighteen months following the same Shareholders’ Meeting. The repurchase authorization will expire on October 12, 2023 unless the authorization is extended or renewed prior to that date.

The Company currently holds 11,065,110 ordinary shares in its portfolio.

The First Tranche replaces any previous share buyback program.

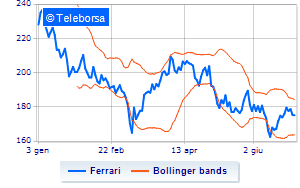

In Piazza Affari, today, the performance of Ferrariwhich brings home a modest -0.11%.