(Tiper Stock Exchange) – Ferrari reported that he has purchased on Euronext Milan (EXM), from 12 to 16 June 2023, a total of 33,291 ordinary shares at the average unit price of 281.3287 euros, for one counter value equal to 9,365,715.29 euros.

These purchases took place as part of the treasury share buyback program of 200 million euro announced on 1 December 2022, as the second tranche of the multi-year treasury share buyback program of approximately 2 billion euro to be completed by 2026.

Ferrari, following the aforementioned purchases, has completed the second tranche of the programme and has made it known that he intends continue in the announced multi-year treasury share buyback programme with a third tranche.

The total consideration invested for the second tranche of the program was:

• 159,999,974.99 euros for no. 660,524 ordinary shares purchased on the EXM

• 42,879,903.44 USD for no. 162,716 shares of common stock purchased on the NYSE

As at 26 June 2023 Ferrari held 12,605,235 ordinary treasury shares equal to 4.91% of the share capital.

From July 1, 2022 to June 26, 2023, the Company repurchased a total of 1,631,648 treasury shares on the EXM and NYSE, including the Sell to Cover transactions, for a consideration of €359,173,738.41.

There third tranche worth up to 200 million euros, will start on July 3rd 2023 and will end by 20 October 2023.

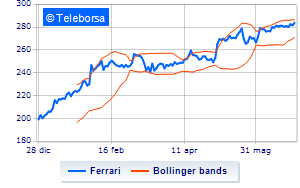

On the Milanese price list, today, checked progress for the prancing horse of Maranellowhich closed up 0.82%.