(Finance) – Down Fedex which changes hands with a loss of 5.15% despite the shipping giant announcing better than expected third quarter results.

The period ended with net profits up from $ 892 million, or $ 3.30 per share, to $ 1.1 billion ($ 4.20 per share). On an adjusted basis theEPS it rebounded nearly 30% to $ 4.59 but turns out inferior to $ 4.64 from the consensus.

In the three months to February 28 i revenues have grown from 21.5 to 23.6 billion dollars, over the 23.4 billion of analysts.

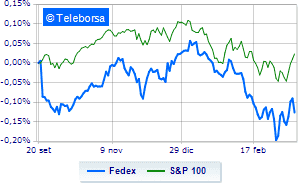

The weekly analysis of the stock with respect toS&P 100 shows a break with respect to the index in terms of relative strength of Fedexwhich is worse than the target market.

The short-term implications of Fedex underline the evolution of the positive phase in the test of the USD 219.9 resistance area. Possible a descent to the bottom 212.8. A strengthening of the curve is expected to test new targets 227.1.