It turns quickly. The shouts of joy over the US stock market rockets in January were replaced at the beginning of February by hailing share prices.

And the expected interest rate cuts from the Fed as early as March may be cancelled.

Instead, more and more are raising the prospect that the Federal Reserve may raise interest rates again during – or even before – the summer.

It reports Bloomberg.

DO NOT MISS : Fat flop: The Swedish big company has lost 93 billion

Pure ping pong match

Lindsay Rosner, a head of research at Goldman Sachs describes the coming interest rate battle as “pure ping pong”.

Most analysts believe that key interest rates will be cut by 75 basis points during the year.

But the more you see of 2024, the less certain that scenario is. But a possible increase in the policy rate would make that less likely.

15 percent risk of higher interest

Lawrence Summers, a Harvard professor who presents analyzes for Bloomberg at regular intervals, estimates the risk of an interest rate increase at about 15 percent.

Mark Nash, macro analysts at Jupiter Asset Management believe the odds are more like 20 percent.

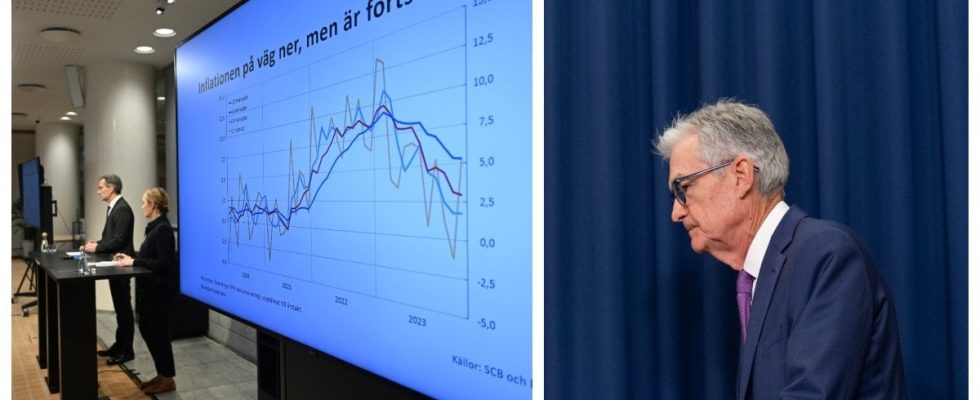

Inflation took off even before the war broke out in Ukraine due to Vladimir Putin’s illegal invasion, energy prices rose all over the world. The only way for the central bank in Washington, just like for the Riksbank in Stockholm and the European ECB in Frankfurt, was to raise policy rates drastically.

Sweden is greatly affected

At the end of 2023, things looked more cheerful. After January’s inflation figures, the Fed’s key interest rates remain unchanged in the range of 5.25 to 5.50 percent.

The Fed’s key interest rate is currently the highest since 2001.

Even in Sweden, the interest rate spurt ended and many hoped for reductions. If the Fed starts lowering interest rates in March, the ECB will probably follow and the Riksbank may start lowering after that.

The chief economist told me Annika Winsth at Nordea to News24 at the beginning of February.

Winsth roars: Should have lowered the interest rate “already yesterday”

Iran’s rebels are hitting the world economy

Those who previously believed in four interest rate cuts in 2024 now only believe in three interest rate cuts.

On the whole, 2024 is an incredibly difficult year to predict without knowing what the key interest rates will be. And the basis for the interest rate policy is a series of volatile factors:

The American internal market, the conflict in the Red Sea and other geopolitical factors such as Israel’s war in Gaza and Russia’s war in Ukraine also affect, and make it difficult to get any predictions, writes Bloomberg.

Read more about the economy:

Winsth roars: Should have lowered the interest rate “already yesterday”

Fat flop: The Swedish big company has lost 93 billion

Bankruptcy at the ancient address: Billion company in the middle of the city

“The profit is more important than the children”: Surprised Akelius poked

Magnificent billion sum: Bianca Ingrosso’s beauty giant is sold again