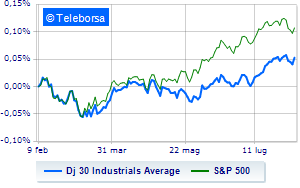

(Finance) – On Wall Street, the Dow Jones it is down (-0.71%) and stands at 35,221 points; along the same lines, theS&P-500, which retreats to 4,483 points, retracing by 0.78%. Negative changes for the NASDAQ 100 (-1.23%); on the same line, under parity theS&P 100which shows a decline of 0.70%.

Investors are worried about the data on the Chinese trade which indicate a slowdown in the global economy. Traders’ sentiment is also weighed down by fears for the stability of stocks US banks which, after the rating cut by Fitchthey also cash in on the downgrade of Moody’s: These are ten small and medium-sized banks, including M&T Bank and Pinnacle Financial. The credit agency also placed some large banks on watch, such as Bank of New York Mellon and US Bancorp, which could soon face a downgrade.

Meanwhile, insiders are wondering when the Federal Reserve will start cutting interest rates. According to John Williams, president of the New York Fed, a reduction in the cost of money will be possible in the first half of 2024, while for Michelle Bowman, a member of the board of the Fed, further increases may be necessary if the l inflation to the 2% target. The wait is therefore rising for an update on the price trend which will arrive this week, Thursday 10 August, and will be able to help clarify the picture for the Federal Reserve’s next moves.

Strong nervousness and losses across the S&P 500 across all sectors, bar none. Among the most negative of the S&P 500 list, we find the sub-funds financial (-1.29%), materials (-1.20%) and informatics (-1.20%).

Unique among the Blue Chips of the Dow Jones to report a significant increase is Amgen (+3.47%).

The strongest sales, on the other hand, show up Goldman Sachswhich continues trading at -2.37%.

Under pressure Salesforcewhich shows a drop of 1.93%.

Slide 3Mwith a clear disadvantage of 1.87%.

In red intelwhich shows a marked decrease of 1.84%.

To the top between Wall Street tech giantsthey position themselves polish (+6.40%), Amgen (+3.47%) and Fortinet (+0.97%).

The worst performances, however, are recorded on Datadogwhich gets -17.62%.

Thump of DexComwhich shows a fall of 10.25%.

Letter about Zscalerwhich records a significant drop of 5.51%.

Goes down CrowdStrike Holdingswith a drop of 4.66%.