(Finance) – Undertone Exxon Mobil, which changes hands with a drop of 2.05% after the American giant announced its third quarter results, which were down, mainly due to the reduction in hydrocarbon prices. Furthermore, the results are lower than the predictions of industry experts.

In detail, ExxonMobil reported net income of $9.07 billion, less than half of the $19.66 billion generated in the same period a year earlier. Earnings per share fell to $2.25 from $4.68 a year earlier, while adjusted EPS fell to $2.27 from $4.45.

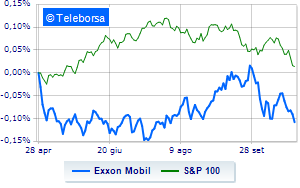

The scenario on a weekly basis of oil group that distributes in Europe under the Esso brand detects a loosening of the curve compared to the force expressed by theS&P 100. This retreat could make the stock subject to sales by operators.

Analyzing the scenario of Exxon Mobil there is a widening of the bearish phase at the test of the USD 103.7 support. First resistance at 108.5. Expectations are for an extension of the negative line towards new lows at 101.9.