Following the export-oriented new economy model announced by President Recep Tayyip Erdoğan with the words “We have only one problem: exports, exports, exports and we will achieve it”, we analyzed Turkey’s latest situation and growth potential in this area.

While Turkey’s share of global exports was 0.86 percent in 2013, it increased to 0.98 percent in 2020.

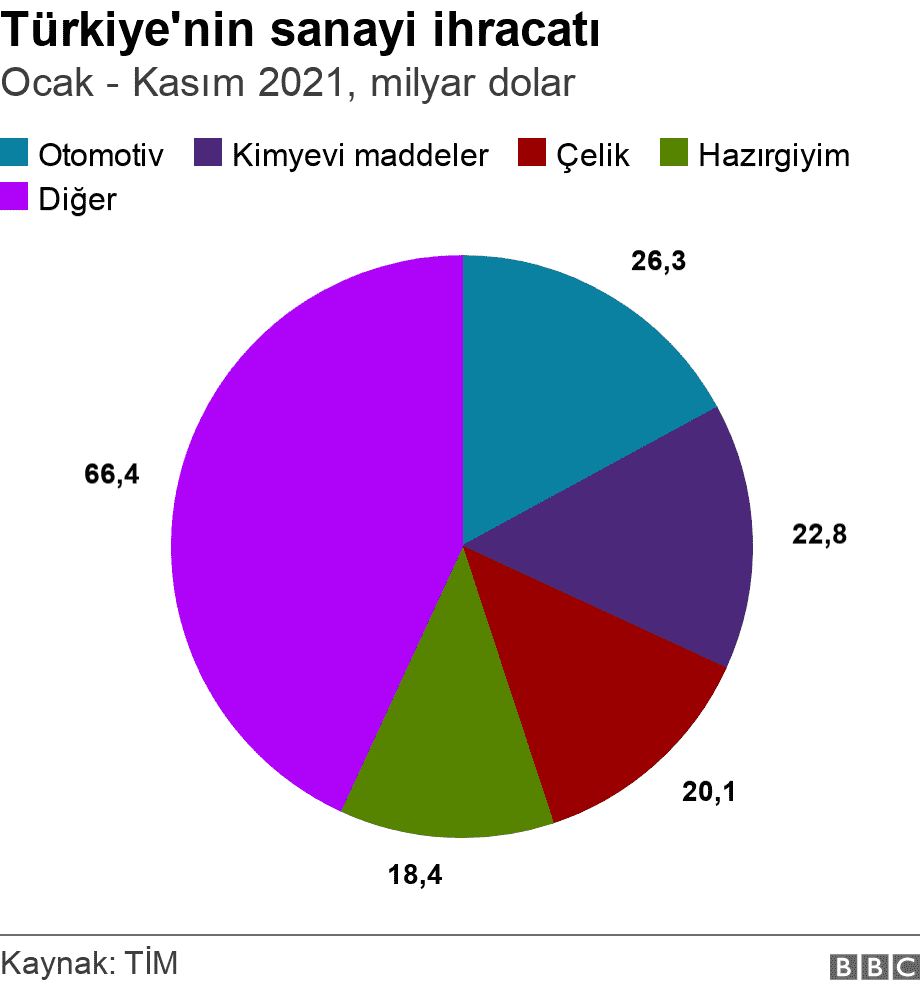

According to the data of the Turkish Exporters Assembly, in the first 11 months of the year, the highest export was realized in the industry sector.

In industrial products, automotive, chemicals, steel and ready-made clothing took the first four places.

BBC TurkishSpeaking to , Şekerbank Chief Economist Dr. Gülay Elif Yıldırım says that in addition to the increase in global commodity prices, China’s withdrawal from the export market for its domestic market after the pandemic played a role in the iron and steel industry’s prominence in 2021.

BBC TurkishSpeaking to , Şekerbank Chief Economist Dr. Gülay Elif Yıldırım says that in addition to the increase in global commodity prices, China’s withdrawal from the export market for its domestic market after the pandemic played a role in the iron and steel industry’s prominence in 2021.

Yıldırım states that the positive outlook in Turkey’s main exporting sectors is related to the growth performance of Turkey’s trade partners in 2021, and that a slowdown may be experienced in global growth in 2022 with the tightening financial conditions.

The success of defense and aviation

On the other hand, the sector with the fastest growth in exports since the beginning of the year was ship and yacht exports, increasing 4.8 times in November compared to January.

Dr. Yıldırım states that this sector, which works with orders and has a high profit share, provides an advantage as the labor costs decrease significantly in terms of foreign currency, and that the sector’s exports have growth potential.

Other sectors with the fastest growth in exports were steel, jewellery, dried fruit products, and the defense and aerospace industry.

Yıldırım emphasizes that defense and aviation, which are among these sectors, have written an important success story, and that they have recently reduced the demand for imports as well as supporting exports:

“With the sector being given importance within the scope of state policy, I expect the strong course of exports as well as domestic production to continue in the coming period.”

Potential in service export

According to Central Bank data, Turkey also realized 63.5 billion dollars worth of service exports in 2019.

47 percent of this was in the travel sector and 38 percent in the transportation sector. The share of telecommunications and information services, which ranked third, was only 2 percent.

Dr. Yıldırım says that the rate of imported inputs in service exports is lower compared to other sectors, so the depreciation in TL may increase service exports more than other sectors. Yıldırım draws attention to the growth potential of tourism and especially health tourism in service exports.

Central Bank analysis: One-third of companies with potential to become exporters do not export

The Central Bank also has a study on companies that do not export despite their high export potential.

According to the study prepared by Economist Ünal Seven, Deputy General Manager Merve Artman and Assistant Specialist Kadir Gürci, 33 percent of companies that have the potential to become exporters in Turkey do not export.

According to this analysis published in July 2021, some sectors stand out in the ratio of companies that do not export despite high potential.

These are the tourism, manufacturing, trade and service sectors.

The authors of the article explain the importance of making these companies exportable with these words:

“While designing policies that support economic growth, development and current account surplus, it is important to consider the sector, scale and city distribution of companies with high potential but not exporting, in order to increase the effectiveness and efficiency of these policies. In addition, by closely following companies that do not export despite their high potential, these companies Eliminating the obstacles/reasons preventing them from making export decisions will contribute to the development goals of our country.

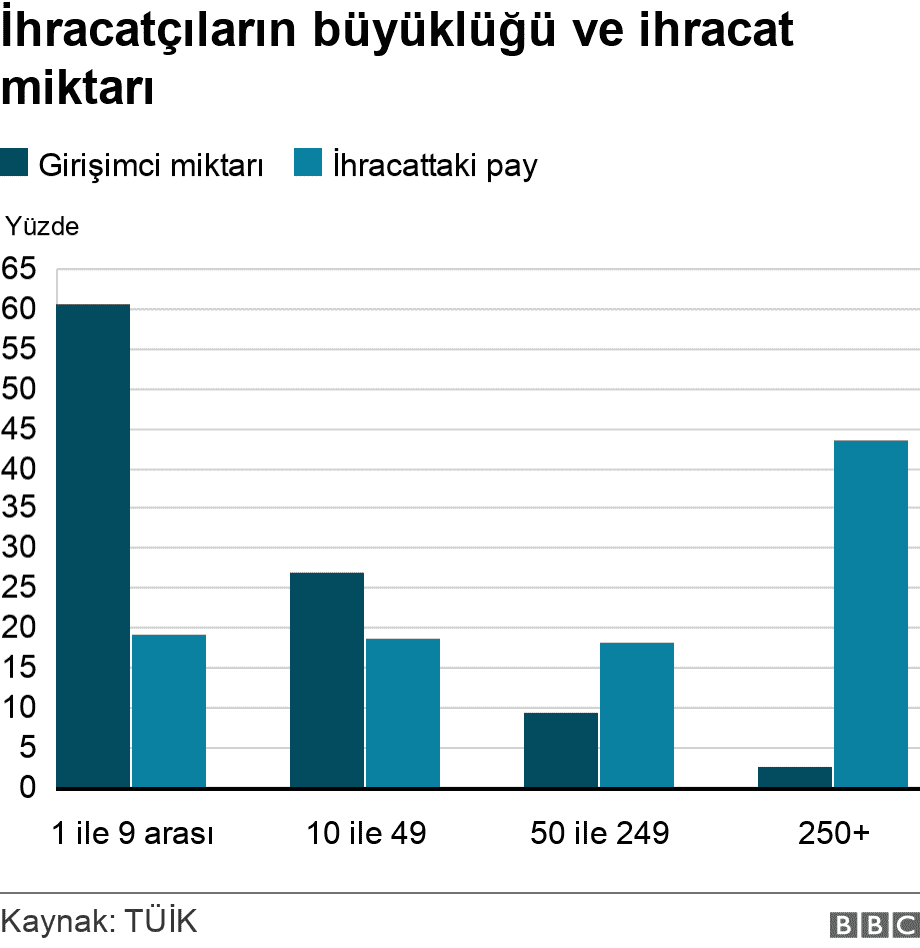

Structure of exporters

According to TUIK data, 60.8 percent of exporting companies are micro-enterprises with a maximum of 9 employees.

Companies employing more than 250 people, on the other hand, have the largest share in exports, although they are few in number.

It may also be useful to look at the Trade Complementarity Index to calculate which countries it is easier for Turkey to increase its exports to.

It may also be useful to look at the Trade Complementarity Index to calculate which countries it is easier for Turkey to increase its exports to.

This index shows which countries’ export structure coincides with the import structure of Turkey the most.

According to the calculation made by Central Bank Senior Economist Ahmet Adnan Eken and Assistant Specialist Didem Yazıcı based on IMF data in April, China, Russia, South Korea, Germany and Italy stand out as countries with high service export potential for Turkey, both in terms of structure and size. it turns out.

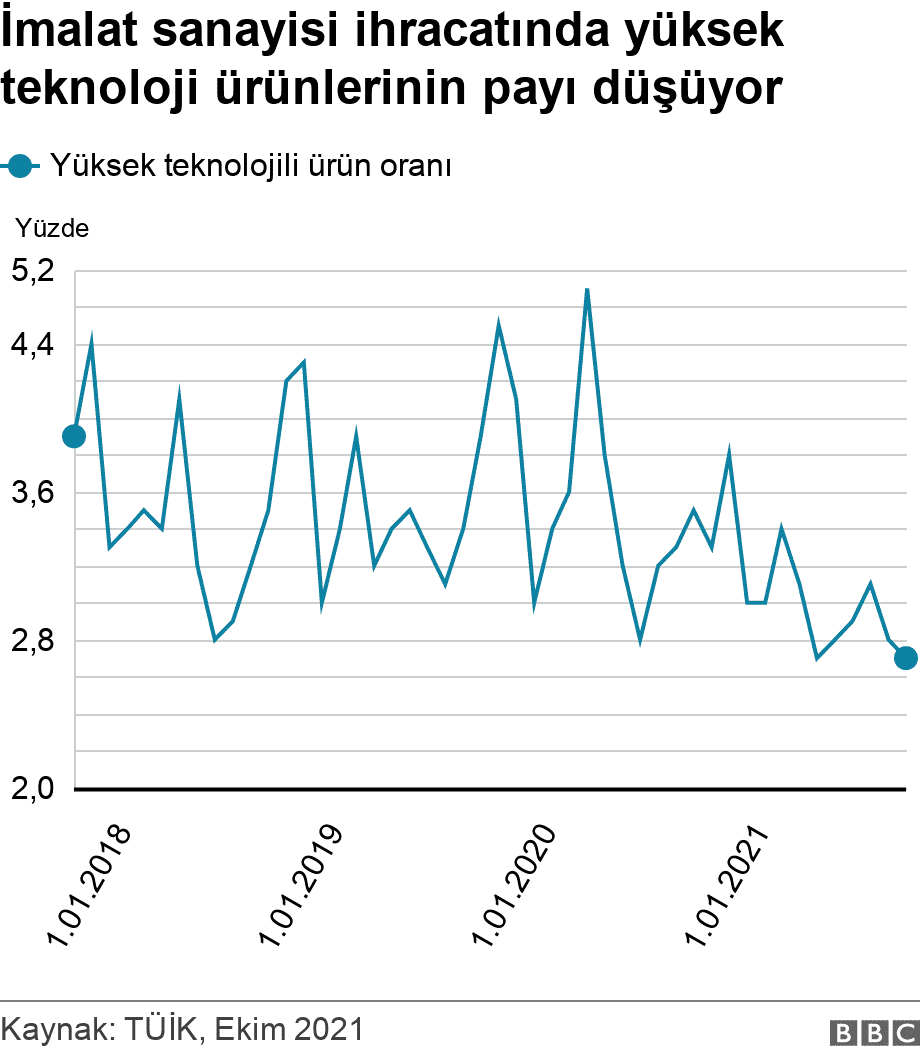

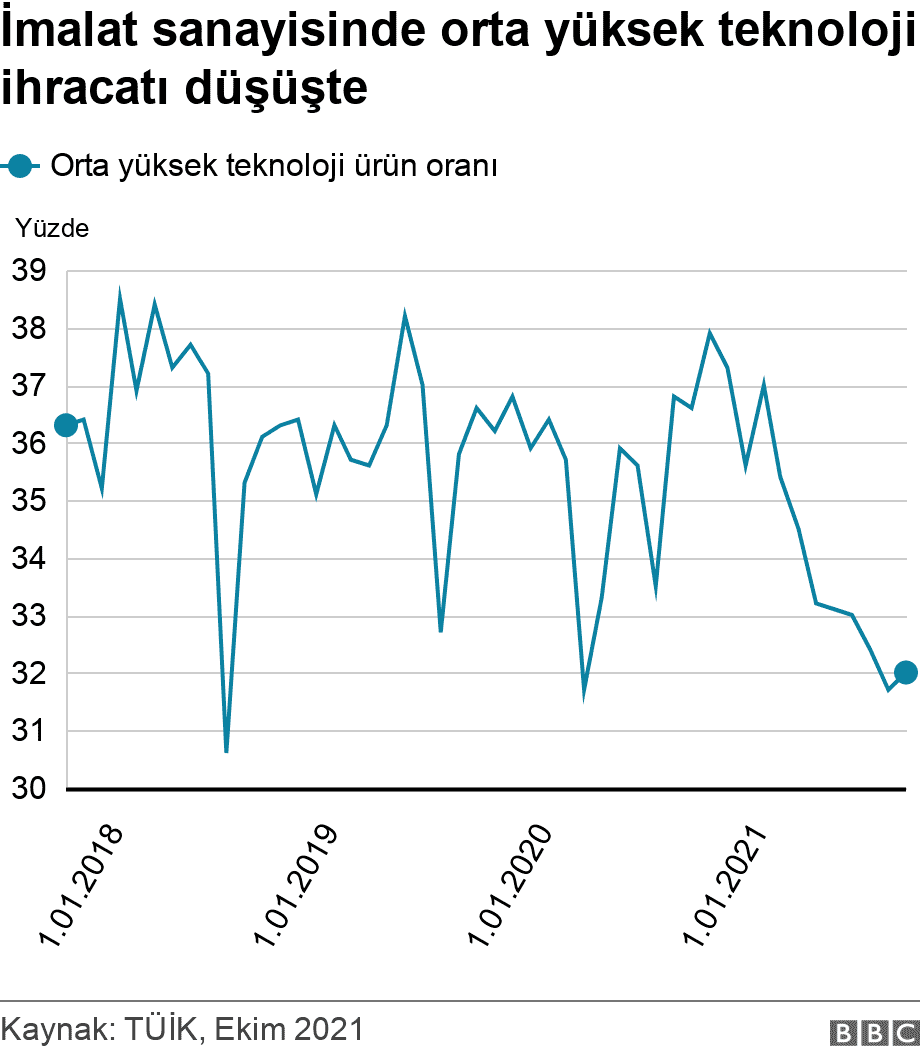

The share of high technology is declining

Another important indicator in exports is the share of low, medium and high technology exports.

Although it is aimed to increase the share of high technology exports in Turkey, the share of both high and medium high technology exports is decreasing.

### ‘The target should be high tech’

### ‘The target should be high tech’

Şekerbank Chief Economist Dr. Gülay Elif Yıldırım draws attention to the fact that although high technology exports increased by 50 percent in dollar terms in the first 10 months of the year, its share in total exports decreased and adds:

“Currently, China, which is taken as an example by the economic program, is now deciding to grow in the export of high-tech products while leaving the classical sectors to other countries. If a change is aimed, the goal here should be to grow with high technology and to establish a plan to establish the necessary education and production infrastructure to achieve this.”

Software export potential

According to the Future of Software Ecosystem in Turkey report prepared by the Turkish Industrialists’ and Businessmen’s Association (TUSIAD), only 0.5 percent of Turkey’s exports come from the software industry, which is reported as a subset of the IT industry. However, the fact that this rate is 2-3 percent in countries similar to Turkey shows that the growth potential in this area is high.

Turkish game software company Peak Games was sold abroad for $1.8 billion in 2020 and became Turkey’s first start-up to exceed $1 billion.

According to Utku Barış Pazar, Head of TÜSİAD Software Working Group, there is an additional employment of 100 thousand and an export potential of 10 billion dollars in this sector until 2025.

When software work can be done remotely and labor and living costs are lower in Turkey compared to developed countries, it seems possible for this sector to increase its production and exports.

Dr. Gülay Elif Yıldırım says that with China’s orientation to the domestic market, an important opportunity has arisen for Turkey in the global export market, and it is of great importance for the medium and long term to increase its share in global exports by offering value-added products in order to benefit from this as much as possible.

Yıldırım adds that the importance of food, which is one of the most traditional sectors, has increased after the pandemic:

“The food sector, which can be evaluated as opposed to turning to high technology, is of particular importance. I think it is vital to reconsider the export/import balance to ensure food supply security, which has entered our lives especially with the epidemic.”