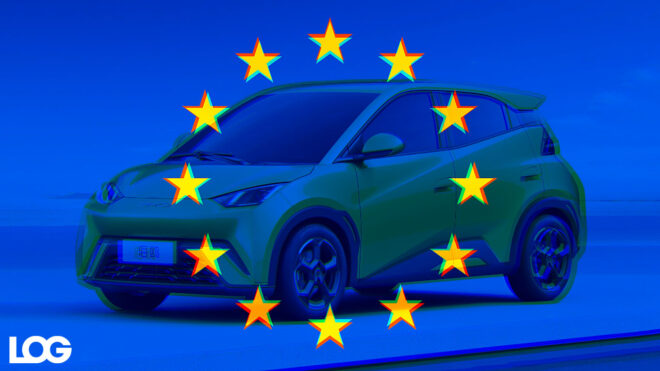

The European Union will fully implement the extra tax on Chinese electric vehicles, which has been on the table for a long time. approved.

Electric vehicles brought to Europe from China will face an extra customs duty of over 30 percent in addition to the 10 percent customs duty. Here, different tax rates are applied depending on the brand/company. For example, the extra tax burden of Tesla vehicles brought from China is 9 percent. BYD’s tax rate is announced as 17 percent, Geely’s as 19 percent, and SAIC’s as 36.3 percent. It is stated that brands that cooperate within the scope of the investigation face a 21.3 percent tax, while those that do not cooperate face a 36.3 percent tax. As we said above, all these rates are added to the 10 percent tax that Chinese cars imported into the EU are currently subject to. The European Union implemented this extra tax, stating that Chinese manufacturers were distorting competition with the large state support they received. The Chinese administration and Chinese manufacturers, not surprisingly, react seriously to this situation. At the same time Germany also did not find the step taken correct and wanted to remove the extra customs duty or soften the conditions. However, the common decision was to impose taxes.

YOU MAY BE INTERESTED IN

Germany, Europe’s largest automobile producer, He stated that the imposed customs duties could harm the success of German automobile manufacturers selling vehicles in China. In recent months, Chinese and European Union officials also met to discuss the extra tax. The Chinese administration wanted the new taxes to be canceled in these negotiations. However, no results were obtained on this issue. Let us note that extra taxes are applied to vehicles brought from China in Türkiye.