(Finance) – Sitting in a rally in Piazza Affari, which widens the upside along with the other European exchanges. Positive balance for the American stock market, where theS & P-500 boasts an increase of 0.67%, after the data on the American labor market which confirm the solidity of the stars and stripes economy and at the same time fuel the bets of a less aggressive Fed on rates to fight high inflation.

Another assist comes from the price of gas which remains under pressure after theG7 agreement for a ceiling on the price of Russian oil and awaiting the reopening of the Nord Stream tomorrow, 3 September.

On the currency market, theEuro / US dollar shows a timid gain, with a progress of 0.58% and with the market betting on a maxi rate hike of 75 basis points by the ECB, in the next meeting. L’Gold the session continues on the upside and advances to $ 1,709.9 per ounce. Strong rise for oil (Light Sweet Crude Oil), which posted a gain of 2.38%.

Consolidate the levels of the eve it spreadsettling at +234 basis points, with the yield of the ten-year BTP standing at 3.85%.

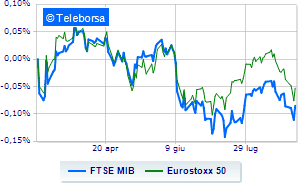

Among the European lists purchases with both hands on Frankfurtwhich boasts an increase of 2.22%, a positive trend for London, which is up by a decent + 1.28%; well bought Paris, which marks a sharp rise of 1.24%. A rain of purchases on the Milanese price list, which shows a gain of 1.66% on the FTSE MIB, thus blocking the bearish trail sustained by five consecutive declines, which started last Friday; on the same line, leap of FTSE Italia All-Sharewhich continues the day at 23,650 points.

Between best performers of Milan, in evidence Exor (+ 4.31%), Iveco (+ 3.02%), Fineco (+ 3.00%) e Banco BPM (+ 2.95%).

The strongest sales, on the other hand, show up on Leonardowhich continues trading at -0.71%.

Basically weak Herawhich recorded a decrease of 0.64%.

Top of the ranking of mid-cap stocks from Milan, Pharmanutra (+ 3.53%), Banca Popolare di Sondrio (+ 3.17%), MPS Bank (+ 3.03%) e Safilo (+ 2.97%).

The strongest sales, on the other hand, show up on Saraswhich continues trading at -2.87%.

Bad performance for Alerion Clean Powerwhich recorded a decline of 2.46%.

Black session for ERGwhich leaves a loss of 2.23% on the table.

At a loss Datalogicwhich falls by 2.22%.

Between the data relevant macroeconomics:

Friday 02/09/2022

08:00 Germany: Trade balance (4.8 billion euro expected; previous 6.2 billion euro)

11:00 am European Union: Production prices, monthly (expected 2.5%; previous 1.3%)

11:00 am European Union: Production prices, annual (expected 35.8%; previous 36%)

14:30 USA: Unemployment rate (expected 3.5%; previous 3.5%)

14:30 USA: Change in employees (expected 300K units; previous 477K units).