(Finance) – The session for Piazza Affari closed with a cautious rise, like the main European stock exchanges, after a volatile afternoon in the wake of the maxi squeeze of the ECB which also revised its inflation estimates upwards and those on growth downwards. The Eurotower has announced new increases in the cost of money that “will depend on the data”. The Wall Street stock market moves slightly higher with theS & P-500 which shows an increase of 0.50% on the day in which the Federal Reserve also reiterated the need for a hard line on monetary policy, through the words of its president, Jerome Powell.

Caution also on the currency market, with theEuro / US dollar a slight decrease of 0.55%. L’Gold the session continues just below par, with a drop of 0.59%. Rain of purchases on oil (Light Sweet Crude Oil), which shows a gain of 1.79%.

The Spread between the yield of the BTP and that of the German Bund it falls, settling at +224 basis points, with the yield of the ten-year BTP reaching 3.95%.

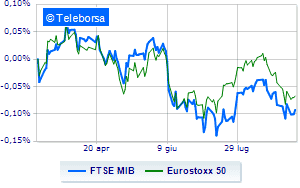

Among the markets of the Old Continent without momentum Frankfurtwhich trades with a -0.09%, positive balance for London, which boasts a progress of 0.33%; tonic Paris, which recorded a capital gain of 0.33%. In Piazza Affari, the FTSE MIB ended the day with an increase of 0.88%, to 21,678 points, continuing the series of three consecutive increases, which began last Tuesday, while, on the contrary, remains around the parity line. FTSE Italia All-Sharewhich closed the day at 23,436 points.

At the end of the session of the Milan Stock Exchange, it appears that the exchange value in today’s session it was equal to 1.55 billion euro, up by 9.47% compared to the previous 1.41 billion; while the volumes traded went from 0.37 billion shares of the previous session to today’s 0.56 billion.

Between best Italian stocks large cap, in the foreground Unicreditwhich shows a strong increase of 6.02%.

Take off Banco BPMwith an important increase of 5.16%.

In evidence BPERwhich shows a strong increase of 3.09%.

It stands out Fineco which marks an important progress of 2.76%.

The worst performances, on the other hand, were recorded on Telecom Italiawhich closed at -5.15%.

Under pressure A2Awhich shows a drop of 2.02%.

It slips Ivecowith a clear disadvantage of 1.80%.

In red Italgaswhich shows a marked decline of 1.75%.

Among the protagonists of the FTSE MidCap, Ariston Holding (+ 3.71%), Saint Lawrence (+ 3.53%), SOL (+ 3.02%) e Bff Bank (+ 2.72%).

The worst performances, on the other hand, were recorded on GVSwhich closed at -5.12%.

Black session for Tinextawhich leaves a loss of 3.59% on the table.

At a loss Saraswhich falls by 2.83%.

The negative performance of MPS Bankwhich falls by 2.39%.

Between macroeconomic quantities most important:

Thursday 08/09/2022

01:50 Japan: GDP, quarterly (expected 0.7%; previous 0.1%)

01:50 Japan: Current items (¥ 714bn expected; ¥ 132bn predecessor)

07:30 France: Employment, quarterly (expected 0.5%; previous 0.3%)

08:45 France: Current items (previous – € 1.5 billion)

14:30 USA: Unemployment Claims, Weekly (240K units expected; previous 228K units).