(Tiper Stock Exchange) – Negative balance for Piazza Affari and the other main European stock exchanges. following the mixed close on Wall Street and weak among Asian stocks. Protests in China over new restrictions against Covid weigh on investor sentiment in light of the country’s record daily infections that undermine consumer demand.

In the background, the focus of operators remains concentrated on central banks: in the early afternoon (15:00) the speech by the governor of the ECB, Christine Lagardewhile in the evening, at 18:00 Italian time, two members of the Fed’s Fomc, Bullard and Williams, will speak.

On the currency market, the session rose slightly due toEuro / US Dollar, which advances to 1.043. L’Gold trading continues with a fractional gain of 0.41%. Deep red for oil (Light Sweet Crude Oil), which continues trading at 73.98 dollars per barrel, down sharply by 3.02%, paying the bill for fears of the economic impact of the situation in Beijing.

On equality it spreadswhich remains at +190 basis points, with the yield on the ten-year BTP standing at 3.87%.

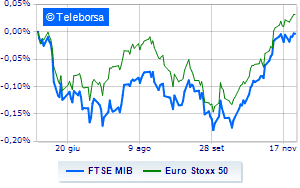

Among the indices of Euroland he hesitates Frankfurtdown a modest 0.59%, under pressure London, with a sharp drop of 0.72%; slow day for Paris, which marks a decrease of 0.61%. At Piazza Affari, the FTSEMIB it is down (-0.97%) and stands at 24,479 points; along the same lines, bad day for the FTSE Italia All-Sharewhich continued the session at 26,486 points, down 0.95%.

Among the best Blue Chips of Piazza Affari, modest performance for Leonardowhich shows a moderate increase of 1.18%.

Resistant Ivecowhich marks a small increase of 0.65%.

The strongest declines, however, occur on Tenariswhich continues the session with -2.57%.

He suffers ENIwhich shows a loss of 1.97%.

Prey of sellers A2Awith a decrease of 1.96%.

They focus their sales on Italgaswhich suffers a drop of 1.93%.

No FTSE MidCap stock has managed to break out of negative territory.

The worst performances are recorded on Saraswhich gets -4.30%.

Sales on IRENwhich records a drop of 2.61%.

Bad sitting for GV extensionwhich shows a loss of 1.85%.

Under pressure Sesawhich shows a drop of 1.76%.

Among macroeconomic appointments which will have the greatest influence on the performance of the markets:

Monday 11/28/2022

10am European Union: M3, annual (expected 6.2%; previous 6.3%)

Tuesday 11/29/2022

half past one Japan: Unemployment rate (previously 2.6%)

01:50 Japan: Retail sales, annual (exp. 4.1%; previous 4.8%)

9:00 am Spain: Consumption prices, monthly (previously 0.3%)

9:00 am Spain: Consumption prices, annual (previous 7.3%).