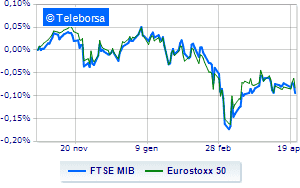

(Finance) – Negative session for European stock exchangeswhich serve the signs of a possible aggressive monetary tightening of the FED against inflation and a normalization of monetary policy also in the Eurozone. There is a “strong likelihood” of an ECB rate hike in 2022, and closing net bond purchases in the early third quarter, Eurotower president Christine Lagarde said in an interview today.

“A More hawkish ECB continues to pose a risk to the EU peripheral area – commented Mark Dowding, CIO of BlueBay – The days of asset purchases seem to be numbered, and although we have seen comments on a backstop mechanism to support spreads, we believe we are still a long way from consensus on such an initiative. European history suggests that such political advances come only in the wake of a crisis and we doubt that there is much incentive to support 10-year BTPs unless the spread with Bunds is well above 200 basis points. “

Caution prevails onEuro / US dollar, which continues the session with a slight decrease of 0.48%. Reverse thegold, which slipped to $ 1,931.3 an ounce. Deep red for oil (Light Sweet Crude Oil), which continues trading at $ 102 per barrel, a sharp decline of 1.72%.

Consolidate the levels of the eve it spreadsettling at +165 basis points, with the yield of the ten-year BTP standing at 2.61%.

In the European stock market scenario black session for Frankfurtwhich leaves a loss of 2.48% on the table, slips Londonwith a clear disadvantage of 1.39%, and at a loss Pariswhich falls by 1.99%.

Black day for the Milan Stock Exchange, which shows a 2.12% drop, while, on the contrary, the FTSE Italia All-Sharewhich closes the session at 27,114 points, on the eve of the day.

Negative changes for the FTSE Italia Mid Cap (-1.25%); on the same line, heavy the FTSE Italia Star (-1.89%).

From the closing figures for Milan, the turnover in today’s session was 2.13 billion euro, down (-4.04%) compared to the previous 2.22 billion; while the volumes traded went from 0.49 billion shares of the previous session to today’s 0.52 billion.

In this bad day for the Milan Stock Exchange, Hera it is the only positive on the FTSE MIB, showing a + 0.47% at the end.

The worst performances were recorded on Saipemwhich closed at -7.54%.

Heavy Telecom Italiawhich marks a drop of -4.37 percentage points.

Negative sitting for Iveco Groupwhich falls by 3.82%.

Sensitive losses for Interpumpdown 3.43%.

Between best stocks in the FTSE MidCap, Cementir Holding (+ 1.92%), Ariston Holding (+ 1.46%), Buzzi Unicem (+ 1.42%) e Safilo (+ 0.90%).

The strongest declines, on the other hand, occurred on Mfe Bwhich closed the session at -7.50%.

Breathless Mfe Awhich falls by 5.01%.

Thud of Mutuionlinewhich shows a drop of 3.65%.

Letter on Secowhich records a significant decline of 3.57%.