(Tiper Stock Exchange) – Positive day for the European markets, with Piazza Affari showing the same trend, on a day in which investors mainly looked to the indications coming from inflation. In the Eurozone, the consumer price index increased by 6.9% in March, after an increase of 8.5% the previous month, recording the largest decline since Eurostat began collecting data in 1991. Nonetheless, the “core” component continues to growwhich excludes volatile energy and food prices and is more closely monitored by the European Central Bank.

On the domestic front, the Istat he communicated that inflation continued to decrease markedly in March, driven by the dynamics of the prices of energy goods. They remain though upward tensions in the sector of unprocessed food, tobacco and services“which lead to a new acceleration in core inflation, the dynamics of which, however, seem to be losing the momentum that had characterized the previous months”, explains a note.

“Overall, today’s figure confirms that the disinflationary process continues, still driven by the energy component; the peak of core inflation has not yet been reached, but it may not be far away – commented Paolo Pizzoli, Senior Economist of Eng – The odds of below 6% average inflation for 2023 have now clearly increased.”

L’Euro / US Dollar the session continued just below parity, with a drop of 0.34%. L’Gold the session continued at the previous levels, reporting a variation of -0.07%. Seat up slightly for the petrolium (Light Sweet Crude Oil), which advanced at $74.87 per barrel.

Slight drop in spreadswhich drops to +177 basis points, while the yield of 10-year BTPs it stands at 4.03%.

Among the markets of the Old Continent essentially tonic Frankfurtwhich records a capital gain of 0.69%, firm Londonwhich marks an almost nothing done, and in light Pariswith a large gain of 0.81%.

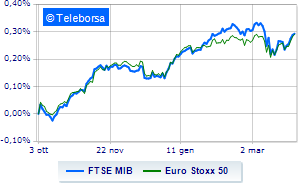

Slight increase for the Milan Stock Exchangewhich shows on FTSEMIB an increase of 0.34%, continuing the bullish trend highlighted by five consecutive gains, triggered last Monday; along the same lines, a small step forward for the FTSE Italia All-Sharewhich comes in at 29,313 points.

Slightly positive the FTSE Italia Mid Cap (+0.25%); almost unchanged FTSE Italy Star (-0.14%).

At the top of the ranking of the most important titles of Milan, we find Nexi (+2.74%), ERG (+2.19%), Moncler (+1.79%) and Campari (+1.40%).

The strongest sales, on the other hand, show up Phinecuswhich closes trading at -1.91%.

Basically weak DiaSorinwhich recorded a decrease of 1.40%.

It moves below parity BPM deskshowing a decrease of 1.37%.

Moderate contraction for Registerwhich suffers a drop of 0.76%.

Between best stocks in the FTSE MidCap, Juventus (+5.07%), Ariston Holding (+4.21%), SOL (+4.00%) and Luve (+3.21%).

The strongest declines, however, occur on Drumswhich ends the session with -1.89%.

Prey of sellers Buzzi Unicemwith a decrease of 1.80%.

Undertone Tinexta showing a filing of 1.77%.

Neglected Rai Waywhich remains glued to the previous levels.