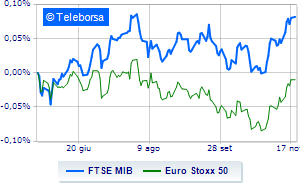

(Finance) – Not very busy day for the main stock exchanges of the Old Continent. Closure on equality also for Business Squareweighed down by detachment of coupons of 12 companies (including eight companies from the FTSE MIB, which weigh 0.84% on today’s performance of the index). Instead, sentiment is supported by Friday evening’s decision to Moody’swhich raised the outlook for Italy from “negative” to “stable”, leaving the rating unchanged at “Baa3”.

On the monetary policy front, some arrived this morning restrictive statements Of Pierre Wunsch (ECB) who reiterated that the markets, excluding further increases, are too optimistic about future monetary policy moves.

L’Euro / US Dollar continues trading with a fractional gain of 0.31%. Caution prevails overgold, which continues the session with a slight decline of 0.31%. Strong rise for the petrolium (Light Sweet Crude Oil), which achieved a gain of 2.81%.

Slight improvement of spreadwhich drops to +172 basis points, a decrease of 3 basis points, while the yield of the 10-year BTP stands at 4.34%.

Among the Euroland indices little moved Frankfurtwhich shows -0.11%, essentially unchanged Londonwhich reports a moderate -0.11%, and remains close to parity Paris (+0.18%).

Business Square closes the session at the levels of the day before, reporting a change of +0.15% on the FTSE MIB; on the same line, remains at the starting line FTSE Italia All-Share (Business Square), which stops at 31,501 points, close to previous levels. Fractional earnings for the FTSE Italia Mid Cap (+0.39%); on the same line, moderately rising FTSE Italia Star (+0.42%).

From the closing data of the Italian Stock Exchange, it appears that the exchange value in the session of 11/20/2023 it was equal to 2.05 billion euros, down by 15.40%, compared to the 2.42 billion on the day before; while the volumes traded went from 0.58 billion shares in the previous session to 0.48 billion.

Between best Italian shares large capitalization, Saipem advances by 2.40%. It is moving into positive territory Amplifon, showing an increase of 2.36%. Money up Moncler, which recorded an increase of 2.34%. Definitely positive balance sheet for Stellantiswhich boasts an increase of 2.30%.

Slow day for Generali Insurancewhich marks a decline of 1.18%.

Between best stocks in the FTSE MidCap, Antares Vision (+6.67%), Seco (+5.34%), De’ Longhi (+2.44%) e Sesa (+2.32%).

The strongest sales, however, hit MortgagesOnline, which ended trading at -6.25%. Sales up Salcef Group, which recorded a decline of 2.63%. Negative session for De Nora Industries, which shows a loss of 2.11%. Under pressure LU-VE Groupwhich suffered a decline of 1.87%.