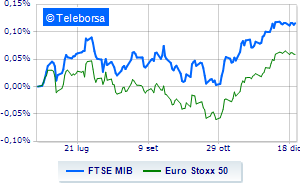

(Finance) – Closing with little movement for European markets in the last session before the Christmas break, with few ideas given the festive climate. In view of the new year, investors’ attention remains on moves by central banks and ai macroeconomic data. On this front, today it emerged that PCE inflation in the United States fell more than expected in November, reinforcing expectations that the Fed could cut rates starting next spring.

L’Euro / US Dollar the session continues at the levels of the day before, reporting a change of +0.05%. Slightly rising seat for thegold, which advances to 2,055.3 dollars an ounce. Caution prevails on the oil market, with the petrolium (Light Sweet Crude Oil) which continues the session with a slight decline of 0.27%.

Improve it spread (differential between the yield of the BTP and that of the German Bund), falling to +156 basis points, with the yield of the ten-year BTP which is positioned at 3.53%.

Among the European price lists remains close to parity Frankfurt (+0.11%), flat Londonwhich holds parity, and without ideas Pariswhich does not show significant changes in prices.

The Milanese price list shows a timid gain at the end, with the FTSE MIB which achieved +0.26%; along the same lines, the FTSE Italia All-Share it makes a small leap forward of 0.26%, reaching 32,470 points. Just above parity the FTSE Italia Mid Cap (+0.27%); with similar direction, fractional gains for the FTSE Italia Star (+0.33%).

The exchange value in the session of 12/22/2023 in Piazza Affari it was equal to 1.4 billion euros, down compared to the 1.55 billion on the day before; while the volumes traded went from 0.7 billion shares in the previous session to 0.69 billion.

Between best performers of Milan, highlighted BPM desk (+1.17%), MPS Bank (+1.02%), Mediobanca (+0.99%) e DiaSorin (+0.93%).

The steepest declines, however, occurred on Amplifon, which closed the session at -0.88%. He hesitates Ferrariwith a modest decline of 0.55%.

Between best stocks in the FTSE MidCap, GVS (+4.44%), De’ Longhi (+2.48%), El.En (+2.12%) e MortgagesOnline (+2.05%).

The steepest declines, however, occurred on Alerion Clean Power, which closed the session at -3.07%. Prey for sellers Carel Industries, with a decrease of 2.61%. They focus on sales Juventus, which suffers a decline of 2.12%. Sales up Tod’swhich recorded a decline of 2.00%.