(Finance) – Piazza Affari buildingwhich does not hook the moderately bullish trend in the main European markets, due to the very low trade on the day of the Immaculate Conception and the long Sant’Ambrogio bridge. However, caution is a must while awaiting data on the US labor market.

L’Euro / US Dollar it is essentially stable and stops at 1.079. L’Gold the session continues at the levels of the day before, reporting a change of -0.02%. Rain of purchases on oil (Light Sweet Crude Oil), which shows a gain of 2.45%.

The Spreads worsens, reaching +179 basis points, with an increase of 5 basis points compared to the previous value, with the yield on the 10-year BTP equal to 4.01%.

Among the markets of the Old Continent without momentum Frankfurtwhich trades with +0.15%, London it is stable, reporting a moderate +0.15%, and substantially toned Pariswhich records a capital gain of 0.60%.

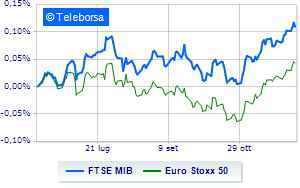

The Milan Stock Exchange pauses on parity, with the FTSE MIB which stands at 30,106 points; on the same line, colorless the FTSE Italia All-Sharewhich continues the session at 32,082 points, on the previous day’s levels.

Without direction the FTSE Italia Mid Cap (+0.16%); moderately rising FTSE Italia Star (+0.23%).

Between best performers of Milan, highlighted Moncler (+3.17%), STMicroelectronics (+1.30%), Nexi (+1.11%) e Amplifon (+1.09%).

The worst performances, however, are recorded on MPS Bankwhich gets -1.57%.

Thoughtful BPERwith a fractional decline of 1.31%.

He hesitates Italian postwith a modest decline of 1.22%.

Slow day for BPM deskwhich marks a decline of 1.01%.

Between best stocks in the FTSE MidCap, Ferragamo (+3.22%), Alerion Clean Power (+3.21%), Brunello Cucinelli (+1.43%) e El.En (+1.43%).

The worst performances, however, are recorded on Pharmanutrawhich gets -1.77%.

Small loss for Intercoswhich trades at -1.4%.

He hesitates LU-VE Groupwhich lost 1.15%.

Basically weak Salcef Groupwhich recorded a decline of 1.05%.

Among the data relevant macroeconomic factors:

Friday 08/12/2023

00:30 Japan: Real household expenditure, monthly (expected -0.2%; previously 0.3%)

00:50 Japan: Current account (previously ¥2,724 billion)

00:50 Japan: GDP, quarterly (expected -0.5%; previously 1.2%)

07:30 France: Employment, quarterly (expected -0.1%; previously 0.1%)

08:00 Germany: Consumer prices, monthly (expected -0.4%; previously 0%).Bla bla