(Finance) – The last session of the year for the main stock exchanges of the Old Continent ended with little movement, who archive 2023 with a great deal of dust trying to forget a more than negative 2022. Piazza Affari conquers the pink jersey in Europe by achieving a positive annual performance of 28%, reaching the highest levels in the last 15 years. The Milanese stock exchange today witnessed the debut of three freshmen on the EGM segment in this last session of 2023: these are Simon, Lemon Systems, Yakkyo.

On the currency market, theEuro / US Dollar maintains the position substantially stable at 1.106. L’Gold it is essentially stable at 2,065.6 dollars an ounce. Oil (Light Sweet Crude Oil) continues the session just below parity with a negative change of 0.02%.

Increase it slightly spreadwhich reaches +167 basis points, with a slight increase of 3 basis points, with the yield on the 10-year BTP equal to 3.68%.

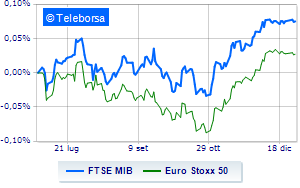

Among the main European stock exchanges moves modestly upward Frankfurtshowing an increase of 0.30%, colorless Londonwhich does not record significant changes compared to the previous session, and without momentum Paris, which trades with a +0.11%. Piazza Affari closed the session at the levels of the day before, reporting a change of +0.07% on the FTSE MIB; along the same lines, the day ends without infamy and without praise FTSE Italia All-Sharewhich remains at 32,479 points.

The value of trades on the Milan Stock Exchange on 29/12/2023 remains around the levels of the day before: from the closing data, it appears in fact that the total value was equal to 1.17 billion euros, with a variation of 1. 96%, compared to the previous 1.15 billion.

Between best Italian shares large capitalization, positive balance for Record yourselfwhich boasts an increase of 0.81%.

Substantially toned Unicreditwhich recorded a capital gain of 0.72%.

Moderate earnings for Mediolanum Bankwhich advances by 0.64%.

The worst performances, however, were recorded on Telecom Italiawhich closed at -1.74%.

He hesitates MPS Bankwhich lost 1.36%.

Basically weak Tenariswhich recorded a decline of 1.35%.

It moves below parity Saipemhighlighting a decrease of 0.88%.

At the top of the mid-cap stocks ranking from Milan, Acea (+1.92%), Philogen (+1.65%), Salcef Group (+1.44%) e Digital Value (+1.31%).

The strongest sales, however, hit GVSwhich ended trading at -2.71%.

They focus on sales D’Amicowhich suffers a decline of 1.74%.

Sales up El.Enwhich recorded a decline of 1.56%.

Moderate contraction for Technoprobewhich suffers a decline of 1.20%.