(Finance) – Negative session for European marketsafter the red of Wall Street (after more cautious statements on the rate cuts front by Fed official Christopher Waller) and theAsia (with the Hang Seng and other Chinese indices experiencing sharp declines after the release of the new macroeconomic data, lower than consensus estimates).

To dampen expectations regarding the timing of an invention of the central banks’ monetary policies were new declarations from the central bankers of the euro area. The president of the ECB Christine Lagarde He said market bets on aggressive rate cuts do not help the fight against inflation, Klaas Knot stated that market expectations of rate cuts risk being self-defeating, Gediminas Simkus highlighted that he is much less optimistic than the markets regarding rate cuts in March or April.

L’Euro / US Dollar maintains the position substantially stable at 1.086. L’Gold the session continues just below parity, with a drop of 0.41%. Widespread selling on oil (Light Sweet Crude Oil), which continues the day at $71.19 per barrel.

On equality, yes spreadwhich remains at +159 basis points, with the yield of the ten-year BTP which stands at 3.86%.

Among the markets of the Old Continent negative session for Frankfurtwhich shows a loss of 1.12%, in apnea Londonwhich retreats by 1.71%, is under pressure Pariswhich suffered a decline of 1.29%.

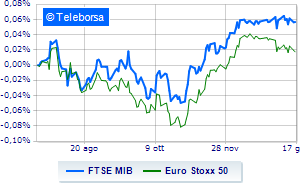

“No” day for Italian stock exchangedown 1.16% on FTSE MIB; on the same line, the FTSE Italia All-Share, which retreats to 32,070 points, retracing by 1.14%. In red the FTSE Italia Mid Cap (-1.08%); with the same direction, downhill FTSE Italia Star (-1.02%).

Between best Italian shares large cap, money up MPS Bank, which recorded an increase of 1.54%. Moderately positive day for Telecom Italia, which rises by a fractional +1.48%. Sitting without momentum for BPM desk, reflecting a moderate increase of 0.85%. Small step forward for BPERwhich shows an increase of 0.63%.

The steepest declines, however, occur at Terna, which continues the session with -2.42%. It slides Monclerwith a clear disadvantage of 2.32%.

n red Italgas, which highlights a sharp decline of 2.07%. The negative performance of Herawhich drops by 2.05%.

At the top of the mid-cap stocks ranking from Milan, Webuild (+2.36%), Philogen (+1.71%) e Juventus (+0.72%).

The worst performances, however, are recorded on LU-VE Groupwhich gets -3.22%. IREN drops by 2.62%. Decline decided for GVS, which marks -2.59%. Under pressure Digital Valuewith a sharp decline of 2.41%.