(Finance) – The last financial session of April for the main European stock exchanges ends upwards, supported by the company quarterly reports, even if the monthly balance still closes in the red. In the background, investors’ attention remains focused on the war in Ukraine and the growth of the global economy.

On the currency market, slight growth ofEuro / US dollar, which rises to 1.054. Plus sign forgold, which shows an increase of 0.74%. Oil (Light Sweet Crude Oil), on the rise (+ 1.3%), reaches 106.7 dollars per barrel.

Slight worsening of the spreadwhich rises to +184 basis points, with an increase of 2 basis points, with the yield of the 10-year BTP equal to 2.78%.

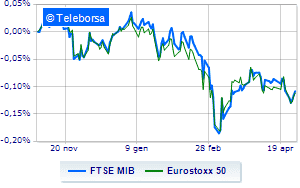

Among the European lists toned Frankfurt which shows a nice advantage of 0.84%, modest performance for London, which shows a moderate rise of 0.47%; resistant Paris, which marks a small increase of 0.39%. Earnings day for the Milan Stock Exchange, with the FTSE MIB, which shows a capital gain of 0.82%, continuing the bullish trail highlighted by three consecutive gains, triggered last Wednesday; along the same lines, the FTSE Italia All-Share ends the day up by 0.94%.

From the closing data of Milan, the exchange value in today’s session it was equal to 2.21 billion euro, down (-5.28%), compared to the previous 2.33 billion; while the volumes traded went from 0.57 billion shares of the previous session to today’s 0.52 billion.

At the top of the ranking of the most important titles of Milan, we find Tenaris (+ 5.26%), Banca Generali (+ 2.52%), CNH Industrial (+ 2.31%) e Unicredit (+ 1.93%).

Stronger sales, on the other hand, fell on Ternawhich ended trading at -1.62%.

Hera drops by 1.14%.

Thoughtful Saipemwith a fractional decline of 0.96%.

He hesitates Snamwith a modest fall of 0.91%.

At the top among Italian stocks a mid cap, Mfe A (+ 9.24%), Mfe B (+ 4.40%), Ferragamo (+ 4.27%) e Autogrill (+ 3.61%).

The strongest declines, on the other hand, occurred on Mutuionlinewhich closed the session at -2.41%.

Heavy Secowhich marks a drop of as much as -2 percentage points.

Decline for IRENwhich marks a -1.59%.

Under pressure Anima Holdingwith a sharp drop of 1.56%.

Between the data relevant macroeconomics:

Friday 29/04/2022

07:30 France: GDP, quarterly (expected 0.3%; previous 0.8%)

08:45 France: Production prices, monthly (previous 0.9%)

08:45 France: Consumption prices, annual (expected 4.5%; previous 4.5%)

08:45 France: Consumption prices, monthly (expected 0.2%; previous 1.4%)

9:00 am Spain: GDP, quarterly (expected 0.5%; previous 2.2%).