(Finance) – Excellent day for European stock exchangeswith investors looking to the timid attempts at dialogue between Russia and Ukraine to end the war. The two countries “are close to agreeing on some clauses they discussed during the talks,” said Russian Foreign Minister Sergey Lavrov. Also in the spotlight Federal Reserve meeting, with analysts believing the US central bank will tighten monetary policy, while there is slight volatility in government bond interest rates. The momentum of the markets was also propitiated by the signals coming from China on new measures to stimulate the economy, after days of sharp falls for Chinese equities.

Slight growth ofEuro / US dollar, which rises to 1.101 meters. Sitting in fractional reduction for thegold, which for now leaves 0.38% on the parterre. Plus sign for oil (Light Sweet Crude Oil), up 0.03%.

Downhill it spreadwhich falls back to +149 basis points, with a decrease of 7 basis points, while the ten-year BTP reports a yield of 1.89%.

In the European stock market scenario incandescent Frankfurtwhich boasts an incisive increase of 3.76%, in the foreground Londonwhich shows a sharp increase of 1.75%, and takes off Pariswith an important increase of 3.68%.

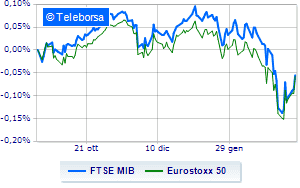

A rain of purchases on the Milanese price list, which brings home a gain of 3.34% on the FTSE MIBconsolidating the series of four consecutive increases, started last Friday, while, on the contrary, the FTSE Italia All-Sharewhich closed the day at 25,674 points.

The FTSE Italia Mid Cap (+ 3.49%); on the same trend, revved up the FTSE Italia Star (+ 4.17%).

On the Milan Stock Exchange it appears that the turnover in today’s session was equal to 2.73 billion euro, from 2.77 billion in the previous session; while the volumes traded today went from 1.1 billion shares of the previous session to today’s 0.83 billion.

At the top of the ranking of the most important titles of Milan, we find Banco BPM (+ 8.73%), Interpump (+ 7.88%), STMicroelectronics (+ 7.50%) e BPER (+ 7.34%).

Stronger sales, on the other hand, fell on Leonardowhich ended trading at -4.86%.

Sales hands on Ternawhich suffers a decrease of 2.67%.

Prey of the sellers Tenariswith a decrease of 1.48%.

Sales focus on Italgaswhich suffers a decline of 1.44%.

At the top among Italian stocks a mid cap, Safilo (+ 14.13%), Zignago Glass (+ 8.48%), Antares Vision (+ 8.47%) e El.En (+ 8.10%).

Stronger sales, on the other hand, fell on Mfe Awhich ended trading at -11.01%.

Bad performance for ERGwhich recorded a decline of 3.30%.

Black session for Ascopiavewhich leaves a loss of 2.69% on the table.

Sales on Sesawhich recorded a decline of 1.82%.