(Tiper Stock Exchange) – Piazza Affari does not move from the values of the eve, in line with the main markets of Euroland. No particular movement even after the publication of the PMI indices by S&P Global. According to research indications, the beginning of 2023 indicated a marginal increase in economic activity in the Eurozone, hinting at a return to growth after six consecutive months of decline. Furthermore, confidence has jumped higher indicating a sharp improvement in business prospects over the next twelve months, while orders show a small rate of contraction.

On the monetary policy front, Joachim Nagel (President of the Bundesbank) said that we must “continue to tighten” and that “the job is not done yet”, while Francois Villeroy de Galhau (governor of the Bank of France) said peak interest rates should be reached “by next summer”.

L’Euro / US Dollar it is substantially stable and stops at 1.087. L’Gold shows a modest gain, with an increase of 0.33%. The Petrolium (Light Sweet Crude Oil) shows a fractional gain of 0.40%.

On the levels of the eve it spreadswhich remains at +184 basis points, with the yield of 10-year BTP which stands at 3.99%.

Among the European lists he hesitates Frankfurtwhich lost 0.24%, substantially weak Londonwhich recorded a drop of 0.22%, and little movement Pariswhich shows +0.05%.

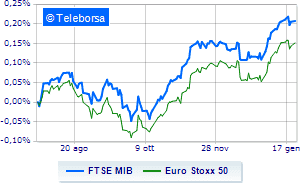

Basically stable Business Squarewhich continues the session on the previous levels, with the FTSEMIB which stops at 25,811 points; along the same lines, moves around parity the FTSE Italia All-Share, which continues the day at 28,010 points. Without direction the FTSE Italia Mid Cap (-0.17%); on the same line, almost unchanged the FTSE Italy Star (-0.07%).

Among the best Blue Chips of Piazza Affari, modest performance for Triad, which shows a moderate rise of 0.90%. Resistant It is in thewhich marks a small increase of 0.75%. Prysmian advances by 0.70%.

The strongest sales, on the other hand, show up Saipem, which continues trading at -2.49%. He suffers Phinecus, which shows a loss of 1.57%. It moves below parity CNH Industrial, showing a decrease of 0.89%. Moderate contraction for ENIwhich suffers a drop of 0.86%.

Between best stocks in the FTSE MidCap, ENAV (+3.15%), Ariston Holding (+2.01%), IREN (+1.45%) and Danieli (+1.28%).

The worst performances, however, are recorded on Technogym, which gets -3.44%. Prey of sellers MPS Bank, a decrease of 1.99%. They focus their sales on Bff Bank, which suffers a drop of 1.96%. Sales on Mfe Bwhich records a drop of 1.90%.