(Tiper Stock Exchange) – Cautious session for the main stock exchanges of the Old Continent. Caution also reigns on the Milan market which is positioned on the same line.

L’Euro / US Dollar it is substantially stable and stops at 1.052. No significant change for thegold, which trades on the previous day’s values at 1,837.5 dollars an ounce. Petroleum (Light Sweet Crude Oil) continues the session at the previous levels, reporting a variation of +0.38%.

Unchanged it spreadswhich stands at +204 basis points, with the yield on the ten-year BTP standing at 4.34%.

Among the main European Stock Exchanges he hesitates Frankfurtdown a modest 0.23%, sitting without momentum for Londonwhich reflects a moderate increase of 0.29%, remains close to parity Paris (-0.01%).

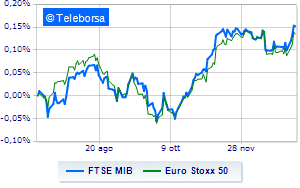

Piazza Affari continues the session on the levels of the eve, reporting a variation of +0.01% on FTSEMIB; on the same line, colorless the FTSE Italia All-Sharewhich continues the session at 26,894 points, on the same levels as before.

Without direction the FTSE Italia Mid Cap (-0.15%); as well, nearly unchanged the FTSE Italy Star (-0.19%).

Among the best Blue Chips of Piazza Affari, a small step forward for Tenariswhich shows a progress of 1.13%.

Composed Herawhich grows by a modest +0.92%.

Modest performance for Leonardowhich shows a moderate increase of 0.77%.

Resistant Triadwhich marks a small increase of 0.71%.

The strongest sales, on the other hand, show up Stellantiswhich continues trading at -1.70%.

Slow day for Pirelliwhich marks a decrease of 1.26%.

Small loss for DiaSorinwhich trades with -1.14%.

He hesitates Nexiwhich dropped 1.03%.

At the top of the mid-cap rankings from Milan, Juventus (+1.10%), Cementir Holding (+0.65%), Mondadori (+0.65%) and Tinexta (+0.61%).

The strongest sales, on the other hand, show up MARRwhich continues trading at -1.97%.

Under pressure Ariston Holdingwhich shows a drop of 1.76%.

Basically weak Mfe Bwhich recorded a decrease of 1.45%.

It moves below parity Mfe Ashowing a decrease of 1.17%.