(Tiper Stock Exchange) – The European price lists are all negative, including Piazza Affari, where TIM stands out after the agreement between MEF and Kkr on the network. Stock markets are looking at central banks and, in particular, at the Fed’s next moves after the July inflation data which consolidated expectations of a halt to further interest rate hikes at its September meeting.

Investors’ attention is also focused on the trend of economic growth, after the signs of a slowdown from China.

On the currency market, theEuro / US Dollar, which trades on the previous day’s values of 1.099. Seat up slightly for thegold, advancing to $1,917.8 an ounce. Light Sweet Crude Oil shows a fractional gain of 0.38%.

On the levels of the eve it spreadswhich remains at +164 basis points, with the yield on the ten-year BTP standing at 4.21%.

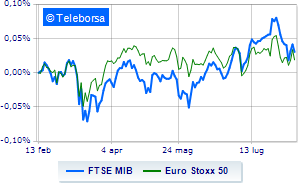

Among the European lists moderate contraction for Frankfurtwhich suffers a drop of 0.41%, London drops by 1.05%, and a marked drop for Paris, which marks a -0.71%. In Milan, it moves under parity on FTSEMIB, which drops to 28,425 points, with a percentage gap of 0.53%; along the same lines, slightly down the FTSE Italia All-Sharewhich continues the day below parity at 30,441 points.

At the top of the ranking of the most important titles of Milan, we find Saipem (+5.50%), BPER (+1.70%) and MPS Bank (+0.94%).

The strongest declines, however, occur on DiaSorinwhich continues the session with -2.93%.

Under pressure Stellantiswith a sharp drop of 2.68%.

He suffers Ivecowhich shows a loss of 1.87%.

Undertone Unipol showing a filing of 1.36%.

Between best stocks in the FTSE MidCap, Sesa (+2.30%), Salcef Group (+1.68%), MARR (+1.23%) and Ascopiave (+1.17%).

The strongest sales, on the other hand, show up MortgagesOnlinewhich continues trading at -4.25%.

Prey of sellers Drywith a decrease of 1.56%.

Disappointing Tinextawhich lies just below the levels of the eve.

Slack Replywhich shows a small decrease of 1.38%.