(Finance) – Negative day for Piazza Affari, which trades heavily, together with the other Eurolistini, while investors are wondering about the next moves of the central banks. After the ECB announcements on the anti-spread shield and theaggressive monetary tightening by the Federal Reserve, the surprise move of the Swiss central bank has arrived. Today, Thursday 16 June, it will also be the turn of the Bank of England which should decide an increase in the cost of money, the fifth consecutive rise. Tomorrow, June 17, it will be the turn of the Bank of Japan which will conclude the two days of monetary policy with the announcement on rates.

On the currency market, theEuro / US dollar the session continued just below par, with a drop of 0.43%. No significant change for thegold, which trades on the day before at 1,831.9 dollars an ounce. Weak session for oil (Light Sweet Crude Oil), which is trading with a drop of 0.07%.

Unchanged it spreadwhich stands at +215 basis points, with the yield on the ten-year BTP standing at 3.91%.

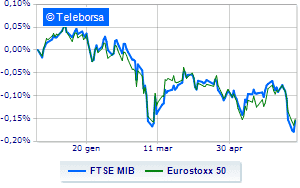

Among the main European stock exchanges black session for Frankfurtwhich leaves a loss of 2.56% on the table, at a loss London, which falls by 1.82%; heavy Paris, which marks a drop of -1.95 percentage points. Black day for the Milan Stock Exchange, which sinks with a 2.23% drop; along the same lines, sales on the FTSE Italia All-Sharewhich continues the day at 23,996 points, down sharply by 2.20%.

Pink sweater among the stocks of the FTSE MIB to show good earnings, Saipem gets + 2.56%.

The worst performances, on the other hand, are recorded on Mediobancawhich gets -4.43%.

Negative sitting for Interpumpwhich falls by 4.41%.

Sensitive losses for Monclerdown 4.20%.

Breathless STMicroelectronicswhich falls by 4.01%.

Among the protagonists of the FTSE MidCap, Antares Vision (+ 2.33%), Juventus (+ 1.56%), Rai Way (+ 1.16%) e Fincantieri (+ 0.92%).

The worst performances, on the other hand, are recorded on Biessewhich gets -5.06%.

Thud of Maire Tecnimontwhich shows a fall of 4.25%.

The negative performance of Banca Ifiswhich falls by 4.07%.

Letter on Bff Bankwhich records a significant decline of 3.86%.

Between macroeconomic variables heavier:

Thursday 16/06/2022

01:50 Japan: Balance of trade (expected -2.022.6 Bn ¥; previously -842.8 Bn ¥)

10:00 Italy: Consumption prices, annual (expected 6.9%; previous 6%)

10:00 Italy: Consumption prices, monthly (expected 0.9%; previous -0.1%)

11:00 am European Union: Labor cost index, annual (previous 1.9%)

14:30 USA: Unemployment Claims, weekly (expected 215K units; previous 229K units).